Learn more about

Products

Best Practice Solutions for the Municipal Security Lifecycle

MuniPOINTS Enables Better Compliance with G-47 Amendments

Brokers, dealers, and municipal securities dealers must comply with G-47 amendments starting March 3, 2025. MuniPOINTS makes this compliance easier.

On July 11, 2024, the MSRB received approval from the SEC for amendments to MSRB Rule G-47, Time of Trade Disclosure. The disclosure obligation includes a duty to give a customer a complete description of the security, including a description of the features that likely would be considered important by a reasonable investor, and facts that are material to assessing the potential risks of the investment.

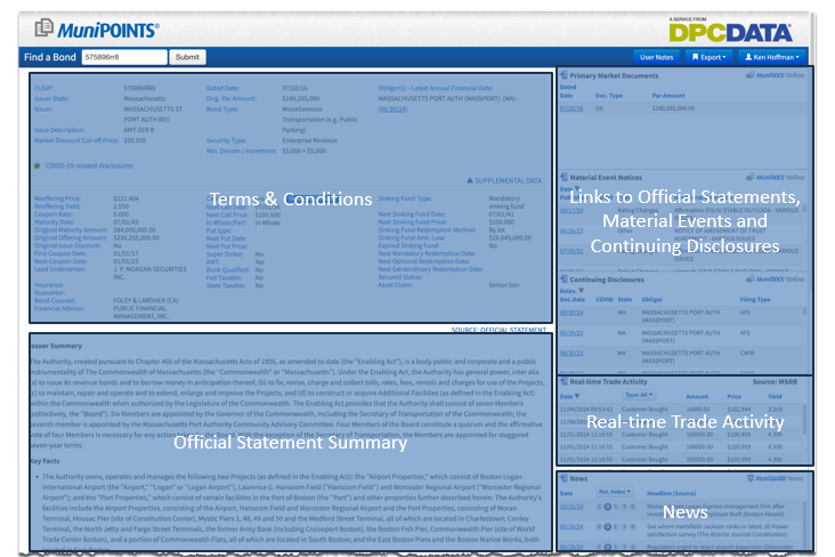

DPC DATA is considered an established industry source for information about municipal securities under G-47, having pioneered the scrubbing, consolidation, digitization, tagging, and dissemination of Official Statements, Material Events, and Continuing Disclosures documents.

A Comprehensive Compliance Solution

Our MuniPOINTS product is composed of four sections:

- Issuer Summary

- Key Facts

- Use of Proceeds

- Bond Security

These sections are extracted directly from the final official statement, with no editorializing, thus mitigating compliance risk under G-47. MuniPOINTS also comes with a compliance reporting module, which generates usage reports for activity relating to searching, downloading, printing, and emailing MuniPOINTS reports.

MuniPOINTS is an auditable, best practice sales and compliance solution with well over 200,000 retail and institutional users in the marketplace.

Combining MuniPOINTS with our MuniDOCS Online and MuniGUARD News results in a comprehensive solution for ensuring time of trade disclosure compliance. Even better, not only does this solution keep financial advisors in compliance, it helps them sell more by providing key information in a quickly digestible format.

The combined MuniPOINTS, MuniDOCS Online & MuniGUARD News solution is integrated with multiple trading platforms and can also be easily added to proprietary systems.

MuniPOINTS Enhancements in Development

The MuniPOINTS platform currently includes certain features available to satisfy some of the new requirements:

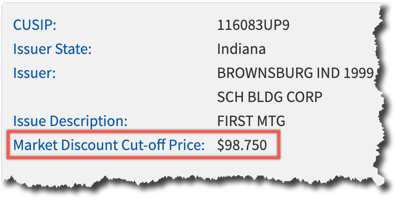

Market discount cutoff price. This enables the broker/dealer to satisfy the Supplementary Material Section 03.p disclosure obligation to show whether a municipal security bears market discount and that all or a portion of the investor’s investment return represented by accretion of the market discount might be taxable as ordinary income.

Example:

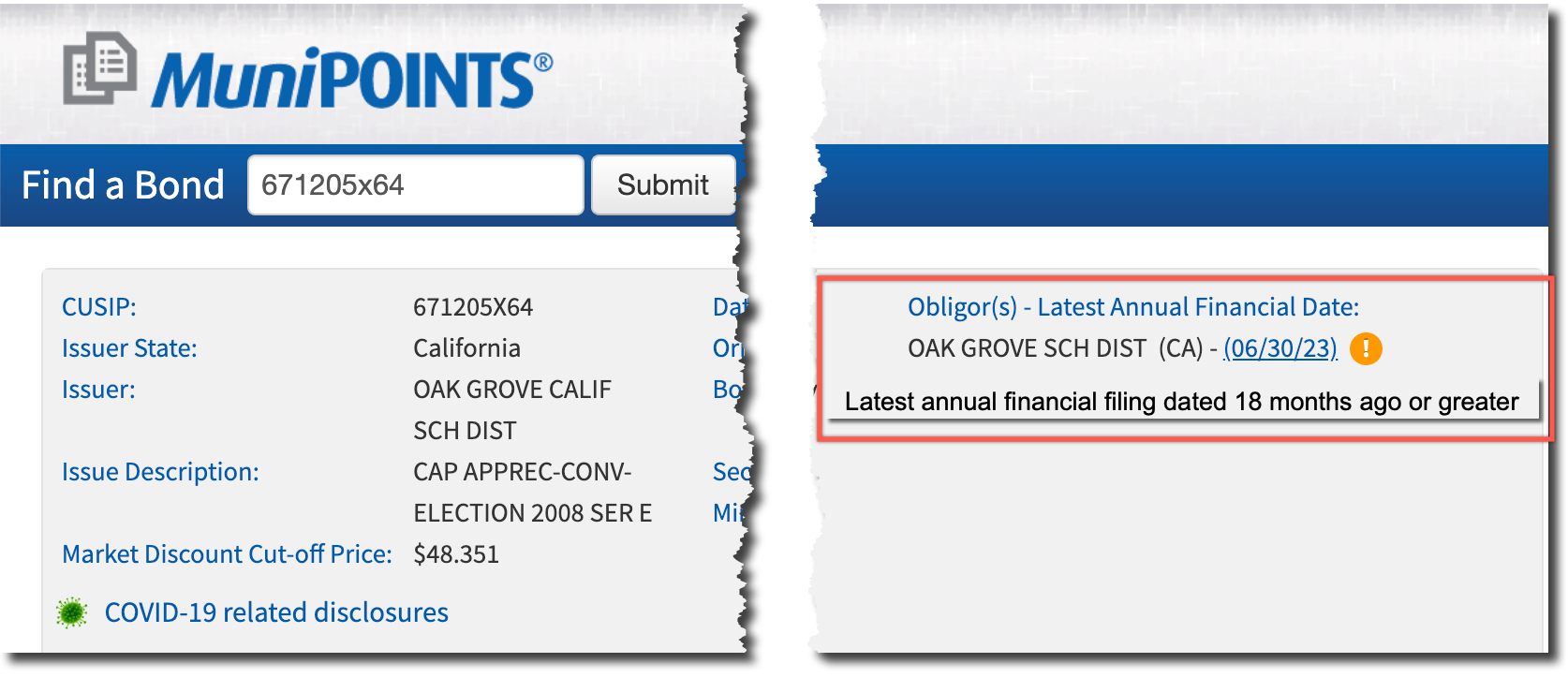

A visual flag that shows whether the latest Annual Financial Information was filed more than 18 months ago.

Example:

We have further enhanced our terms and conditions data with the following updates to address the new G-47 amendments set to take effect in March 2025:

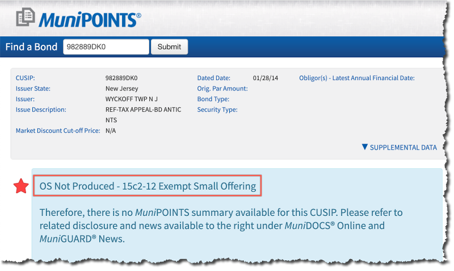

Unavailability of an Official Statement. The fact that no OS is available on EMMA or that it is only available from the underwriter (Section 03.s).

Example:

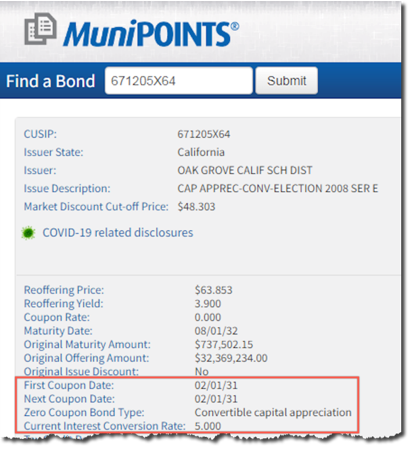

Zero Coupon or stepped coupon bonds. (Section 03.q)

Example:

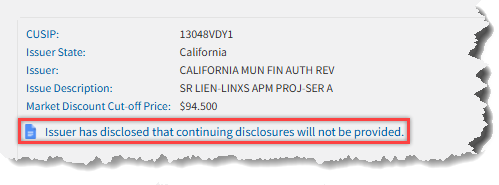

Whether a continuing disclosure may be unavailable. (Section 03.t)

Example:

Credit Enhancement Types. In addition to currently available information on Insurers and Guarantors, the following 18 additional credit enhancement types will be included (if applicable):

- Bond Purchase Agreement

- Confirming Letter of Credit

- Collateralized Letter of Credit

- Collateral Agreement

- Federal Deposit Insurance Corporation

- Federal Savings and Loan Corporation

- Guaranteed Investment Contract

- Guaranteed

- Indirect Letter of Credit

- Insured Letter of Credit

- Line of Credit

- Liquidity Facility Agreement

- Letter of Credit

- National Credit Union Association

- Put Letter of Credit

- Stand-by Letter of Credit

- School Bond Loan Program

- Surety Bond

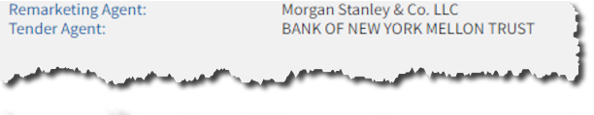

Financing Team. Includes the identification of Tender and Remarketing Agents.

Example:

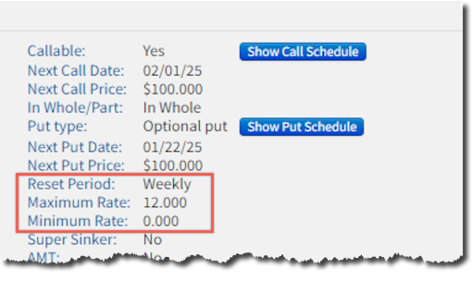

Interest Rate Reset. Description of the basis on which periodic interest rate resets are determined.

Example:

Learn more about MuniPOINTS and G-47 compliance

Contact us at 800-996-4747 or sales@dpcdata.com to learn more about using MuniPOINTS to satisfy your firm’s G-47 compliance requirements.

Get the latest advances in your inbox!

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.