Learn more about

Products

Best Practice Solutions for the Municipal Security Lifecycle

MuniCLIMATE Solutions FAQs

Find the answers to the most commonly asked questions about MuniCLIMATE Solutions here.

Why have you rebranded from MuniESG to MuniCLIMATE?

There is currently no yield premium or penalty in the market for Climate Risk, so why should I care?

Isn’t federal disaster relief going to bail out most municipal credits anyway?

What municipal sectors do you have MuniCLIMATE scores for?

What Climate data sources are available through DPC DATA and what’s the coverage?

What are the key differences between the two data vendors for MuniCLIMATE?

There are many Climate data vendors out there. Why should we go through DPC DATA?

Who is SRS, and why do you use them?

Who is First Street (FS), and why do you use them?

How are the Kestrel scores different from the Climate scores available through DPC?

—–

Why have you rebranded from MuniESG to MuniCLIMATE?

When it comes to “ESG”, we’ve always made a critical distinction between “Risk” factors and “Impact” factors. Risk factors have always been part of traditional muni credit analysis and can be more objectively quantified through existing data. On the other hand, Impact factors depend on each investor’s subjective social values and can only be determined by the investor in partnership with their investment advisor.

Our opinion has been borne out over the past 2 years as the financial markets have moved away from the more controversial and politicized aspects of Climate and focused more on the effects of Climate Risk on financial assets.

The property insurance crisis in states such as FL and CA has also received a lot of media coverage this year. We believe that the rising scarcity and cost of insurance coverage will have a negative impact on property values in the affected localities and eventually on their local economy and tax base.

Our renewed focus on Climate Risk factors complements and enhances our existing MuniCREDIT Solutions.

—–

There is currently no yield premium or penalty in the market for Climate Risk, so why should I care?

Historically, our market has always been more reactive than pro-active with regard to systemic risk factors. This means what the market’s reaction, when it does come, will be sudden and dramatic, not gradual. If you wait until it happens, it will probably be too late.

The lack of market reaction to date is actually a great opportunity for investors with foresight to minimize the potential risk to their clients’ portfolios at virtually no cost, i.e., without giving up any yield or return potential.

—–

Isn’t federal disaster relief going to bail out most municipal credits anyway?

It is true that, historically, the credit impact of major disasters on municipal credits has been mitigated by federal relief. However, in the current environment of massive federal budget deficits, investors can no longer assume unlimited federal assistance going forward. FEMA, for instance, is reportedly starting to run out of money.

Aside from acute events such as hurricanes and tornadoes, chronic climate events such as river flooding, excessive heat and drought don’t always qualify for federal relief and will eventually erode a community’s socio-economic foundations as more residents start to move away from affected areas.

—–

What municipal sectors do you have MuniCLIMATE scores for?

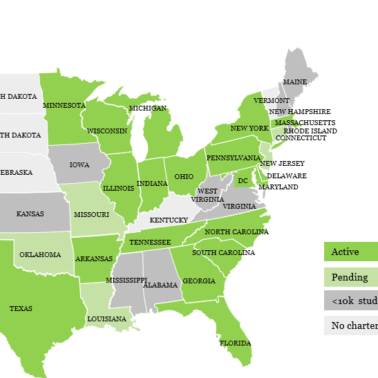

We currently have coverage of all the so-called “essential service” sectors, including States, counties, cities, school districts, and municipal utilities. The next sector to be completed this year will be the Development Districts sector for all major states, which is most vulnerable to localized Climate events impacting local property tax bases.

We plan to eventually have MuniCLIMATE scores for all sectors for which we collect financial data.

—–

What Climate data sources are available through DPC DATA and what’s the coverage?

We currently carry climate data from two best-in-class subject matter expert firms: Spatial Risk Systems (SRS) and First Street (FS).

Spatial Risk Systems (SRS)

SRS provides comprehensive environmental, physical and transition risk scores based on historical government data sources. It currently covers all states, counties, cities, school districts, and municipal utilities (21,925 obligors).

- Cities: 6,744

- Counties: 1,762

- School Districts: 9,040

- States: 50

- Municipal Utilities: 4,329

Scores are available for all 18 natural hazards defined by FEMA. The data is fully integrated into our web-based MuniCREDIT Online app. Users can access the data and key derived risk ratios through the app or through a data feed.

First Street (FS)

FS provides hazard exposure metrics for all perils (Flood, Wildfire, Wind, Extreme Heat, and Air Quality) at the county, city, or census tract level, incorporating risk changes due to climate change today and 30 years from now. The FS data is currently available only through a data feed, for (1) 85,139 census tracts; (2) 31,909 cities and (3) 3,220 counties. A total of 10,755 obligors are mapped by DPC DATA to the correct obligor at the individual issue level and to individual CUSIP-9s:

- Cities: 5,405

- Counties: 1,764

- Municipal Utilities: 3,586

—–

What are the key differences between the two data vendors?

The SRS data is based only on historical data at this time. It covers more granular categories of climate events. The SRS scores are also fully integrated into our MuniCREDIT Online application. The SRS option is most appropriate for users seeking a turnkey solution without additional need for technical development resources.

The FS data is forward-looking (i.e. based on projections). It covers only the 4 major climate events (arguably, the most important ones) along with one Environmental factor (Air Quality). It is most appropriate for power users looking for forward-looking data to feed their internal workflow applications.

—–

There are many Climate data vendors out there. Why should we go through DPC DATA?

DPC DATA’s platform is uniquely designed for all participants in the municipal market who need reliable climate information at the individual security level.

All climate data points are mapped to the correct municipal obligor (based on credit), its Census Geo-ID (if available) and then to the individual security’s CUSIP-9. The CUSIP linkage allows users to easily import the scores into their credit analysis and portfolio management internal workflow software.

Users can easily combine financial data from DPC’s MuniCREDIT Solutions with its MuniCLIMATE Solutions into a comprehensive credit risk assessment framework, all through one platform.

—–

Who is SRS, and why do you use them?

Spatial Risk Systems (“SRS”) is the market leader in spatial-level data governance engineering innovative reference data and analytics solutions. It enables institutions to accurately assess risks and opportunities at the underlying asset locations of their investments, transactions, and operating activities.

We have chosen to partner with SRS because their principals come from FactSet, Bridgewater, and Moody’s and have extensive experience in meeting the data needs of investment professionals. In contrast, most other CLIMATE data vendors come from a public policy background and, in our opinion, are not quite as attuned to the workings of the capital markets.

Get a deep-dive on SRS.

—–

Who is First Street (FS), and why do you use them?

We chose First Street for the following reasons:

- Before re-incorporating as a for-profit entity, FS was a non-profit foundation that made key climate risk metrics at the individual property level available to the average homeowner, through major real-estate websites such as RedFin. We think this is a game-changing approach that has the potential of affecting future property values.

- FS mission is quantify the link between climate risk and financial risk at the individual property level.

- FS uses physics-based, fully transparent, peer-reviewed risk models that calculate property-level financial risk assessments. No “black box” here.

- FS data has already received broad adoption from leading financial institutions, governing entities (including FEMA itself), and asset managers.

- A relatively new startup, but well-financed, having just completed a $46M Series A round, with funding from several climate-oriented VC firms and, most relevant to municipal market participants, Nuveen, a TIAA company.

—–

One of your competitors recently added “Sustainability Scores” from Kestrel to all their municipal products. How are the Kestrel scores different from the Climate scores available through DPC?

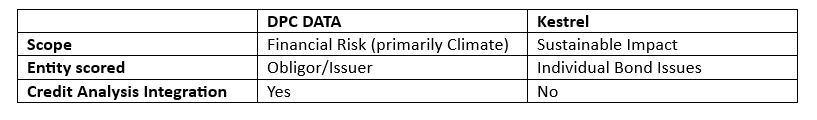

Kestrel specializes in ESG verification and certification for individual bond issues (e.g. “green” or “social” bonds). As a result, their scores are quite different from the Climate Risk scores we carry from SRS and First Street:

Recall that “impact” is the more controversial aspect of “ESG Investing” and the primary reason why there’s a backlash against ESG-type strategies. DPC has chosen, through our re-branding, to focus on Climate Risk, as a component of overall Municipal Credit Risk.