Learn more about

Products

Best Practice Solutions for the Municipal Security Lifecycle

MuniGUARD Monitor

Monitor market activity and mitigate compliance risk

MuniGUARD Monitor is designed for asset managers, registered investment advisors, portfolio managers and other institutional municipal market professionals. These individuals typically need to have a broad understanding of their municipal holdings with respect to ongoing disclosure and forces affecting the performance of a bond – all generally reported in the local daily news.

Premium portfolio monitoring tool. MuniGUARD® Monitor provides easy access to critical disclosure information including material events, MuniPOINTS® Deal Summaries, and local news stories. These are all linked at the CUSIP® and Obligor identification levels.

The service allows you to:

- Closely monitoring market activity that may affect a bond’s credit profile

- Obtain reliable alerts on new evidence of bond distress, so that you can protect your customers or your portfolio

- Mitigate compliance risk under MSRB Rules G-17, G-19 and G-30 by ensuring timely access to critical event data as soon as it is available

MuniGUARD Monitor reports all portfolio information at the CUSIP®-9 level and includes a configurable email alert capability. In addition, it is delivered through a user-configurable Web interface.

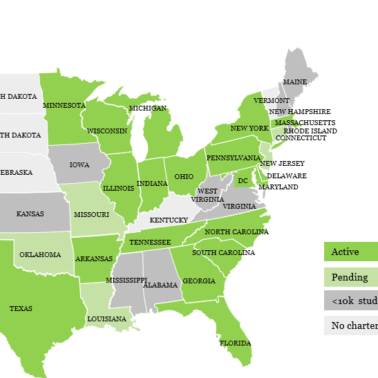

News updates and scrubbed data

MuniGUARD Monitor homogenizes essential municipal disclosure information that DPC DATA thoroughly scrubs and indexes. It provides current, related news stories from more than 500 domestic news organizations redistributed by DPC DATA’s MuniGUARD News under license. This product helps dealers deliver relevant information to clients at the point of sale, with a complete audit trail.

You can manage multiple municipal securities portfolios from the MuniGUARD Monitor dashboard. Also, each portfolio can be tailored to your particular disclosure and news information needs. For example, a pure holdings portfolio based on CUSIP-9s can be set up to closely track all new information flows all at once. A tracking portfolio based on obligors or issuers can also be configured for different frequency of notifications.

For more information and a demonstration of how easily MuniGUARD Monitor can be integrated into your trading and portfolio management system, contact us at 800-996-4747 or sales@dpcdata.com.

Get the latest advances in your inbox!

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.