Learn more about

Products

Best Practice Solutions for the Municipal Security Lifecycle

MuniCREDIT Mapping

Accurate, Efficient, Cost-Effective: DPC DATA’s Proprietary MuniCREDIT Mapping for Municipals. Part of Our MuniCREDIT Solutions Portfolio.

Municipal Issuers are facing their greatest credit challenges since the Financial Crisis. Do you know where the true credit exposure is in your portfolio?

Due to the bespoke nature of the municipal market involving thousands of issuers and a multiplicity of distinct security structures, market participants have historically struggled to come up with an appropriate obligor and sector classification methodology.

Existing classification schemes from major data providers, while certainly helpful, tend to confuse the nature of the “Obligor” with the security feature specific to the individual bond series or even with the purpose of the bond issue.

As a result, many traders and investors have had to cobble together their own internal sector mapping schemes. This is a time consuming, expensive, and ultimately non-scalable process.

DPC DATA Gets Obligor and Sector Mapping Right

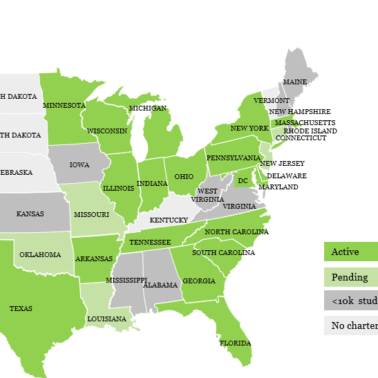

With over 30 years of municipal data expertise, we understand the fundamental aspects of the data to be identified and mapped. We developed a pioneering Obligor and Sector Mapping methodology to identify the true Direct Obligor in each transaction – our only criterion is “Credit” – then re-map all Sector Classifications based on this identification. The work is conducted by our experienced credit research analysts – not technology staffers who do not understand credit nuances.

- Ability to identify any Issuer’s Capital Structure

- Sectors mapped to the individual issue level (CUSIP-9)

- Data templates created to accommodate 100+ Sectors/Subsectors

Benefits to Investors & Traders

The MuniCREDIT Mapping system, which is part of our new MuniCREDIT Solutions portfolio, enables accurate, efficient and cost-effective sector classifications. These classifications are the foundation of mission-critical investment functions such as:

- Risk identification and aggregation. Portfolio managers and risk managers can effectively gauge aggregate exposure under various risk scenarios.

- Compliance with investment diversification rules. Accurate sector assignment is critical to achieving the risk diversification intent of such compliance rules.

- Trading. Accurate Obligor/Sector assignments can serve as the basis for any relative value system which seeks to match trading levels with the correct underlying credit.

- Bond pricing and evaluation. Accurate obligor identification can allow any matrix-based bond evaluation system to improve pricing accuracy and reduce manual intervention by pricing analysts.

Why DPC DATA?

DPC DATA believes in helping our clients in the fixed income industry make wiser decisions and avoid compliance penalties by providing scrubbed, accurate and actionable data via solutions that offer a balance of quality, reliability and price.

MuniCREDIT Mapping is part of our growing MuniCREDIT Solutions portfolio, which is built on:

- Over 30 years of innovative, market-driven data solutions

- An analyst team with over 250 years of combined Muni Data experience

- Solutions developed in partnership with experienced credit analysts and other power users

- Extensive distribution platform already in place

- Independent, platform-agnostic data offerings

To learn more about MuniCREDIT Mapping, contact your DPC DATA representative or email sales@dpcdata.com.

Get the latest advances in your inbox!

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.