Resources

[RESEARCH] Recent Municipal Disclosure Trends and Their Post-Pandemic Implications

Before the municipal market was slammed by the coronavirus, the topic of municipal disclosure timeliness had once again reared its ugly head. Our analysis reveals that while timeliness improved from 2012 to 2018, 2019 was a different story. In the post-pandemic world, restoring reporting timeliness will be critical to regaining investor confidence.

.Municipal Disclosure Trends – Back in February, before the municipal market was shaken to its core by the current coronavirus-related fiscal crisis, the topic of municipal disclosure timeliness (or the lack thereof) had once again reared its ugly head. The catalyst for the latest round of industry debate was the MSRB’s proposed Submission Calculator, as approved by the SEC on February 18th, 2020.

The MSRB Submission Calculator displays the length of time between the end of an issuer’s fiscal year and the date the annual disclosure for that fiscal year was posted to EMMA. It is meant to be a yardstick for disclosure timeliness. Since the MSRB will not try to evaluate the content or significance of any submission, the Calculator, whenever it’s implemented, will be at best a very mechanical and crude attempt to promote timely disclosure.

The Submission Calculator grew out of the SEC’s rising impatience over the slow pace of disclosure improvement in the tax-exempt market. Under the Tower Amendment, the SEC and, by extension, the MSRB, cannot directly impose disclosure requirements on issuers. As a result, the market regulators have instead shifted the burden of disclosure compliance onto the broker-dealers who provide investment banking services to municipal issuers, resulting in the Municipalities Continuing Disclosure Cooperation Initiative (commonly referred to as “MCDC”) which went into effect in 2014.

Not surprisingly, the MSRB’s new tool has come under heavy criticism from market participants, even before it was implemented. Issuers expressed concern about potentially getting penalized by the market for purely technical factors, such as a delay between the completion of the annual audit and the time it actually gets posted to EMMA. The National Federation of Municipal Analysts (“NFMA”) noted the frequency of submission errors on EMMA, which may undermine the accuracy of the timing calculator.

Lack of timely financial transparency creates tension

Truth be told, financial transparency has always been a source of tension between municipal issuers and the investor community. In spite of their ongoing dependence on capital market access, state and local governments have historically been reluctant to provide timely financial disclosure. They argue the cost of compliance, particularly for resource-constrained small local governmental units, far outweighs the potential benefit to the investing public. They also point to the absence of any clear market penalty for disclosure deficiencies, given the relative lack of supply in a low interest rate environment.

On the other side of this argument are public policy advocates and the municipal investor community, who claim that timely fiscal transparency is critical to sound public finance practices as well as to the accurate pricing of credit risk in the municipal market. This position was bolstered by a recent report from Merritt Research Services, which documents annually “the time it takes for municipal bond borrowers to complete their annual financial audits”. In this latest installment, Merritt found that, across a universe of 10,700 distinct borrowers, “the median audit time grew to 156 days for Fiscal Year 2018. This was two days longer than the previous year. The last time the median audit time was this slow in the last 11 years was 2015”.

Now, the Merritt report was clearly predicated on what constitutes sound fiscal policy according to public finance experts. Once one moves away from a public policy viewpoint, however, a very different picture emerges. Instead of focusing on what municipal issuers should be doing as a matter of sound public policy, shouldn’t we focus instead on what issuers are actually required to do as part of their MCDC-related disclosure covenant? How well have they been complying with their own disclosure covenants?

In response to this question, DPC DATA has analyzed the 2019 data disclosures of roughly 33,000 unique obligors with a total population of 38,916 audited and unaudited financial statements and comprehensive annual financial reports (CAFR). In looking at municipal disclosure trends, our study does not rely on the raw submissions on the EMMA site, which may contain filing errors, but on filing date data that DPC DATA has checked and validated, as displayed in our MuniPoints® and Filings Summary services (For more details on our methodology, please refer to our previous research paper).

A trend towards improved timeliness

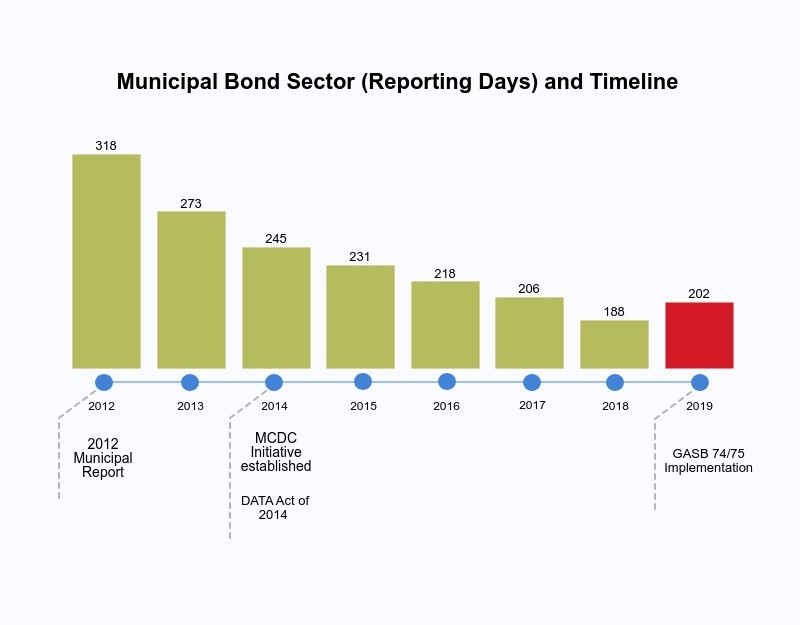

As shown in the graph below, the timeliness of financial disclosure did improve steadily from 2012 up to 2018. One can clearly argue that MCDC has had a significant impact in pushing municipal issuers into better transparency.

2019 breaks the improving municipal disclosure trends

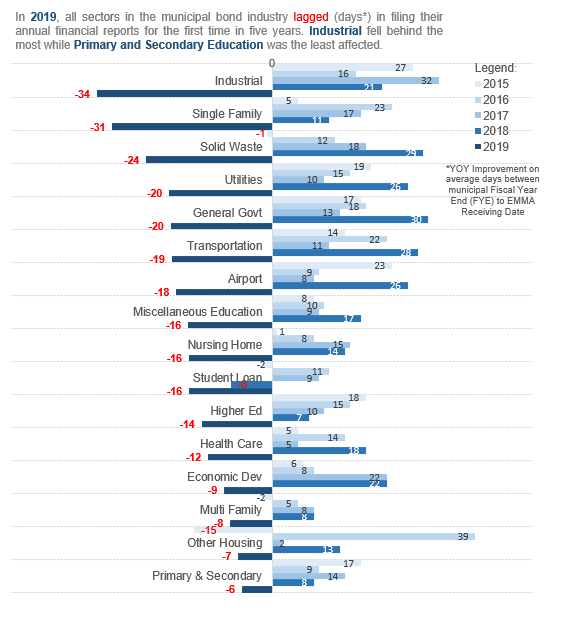

Unfortunately, the improving trend was broken in calendar year 2019, which covers disclosure primarily related to fiscal year 2018. Not only did the whole municipal sector report 14 more days later, on average, compared to the previous year, every sector experienced a setback, as shown below:

The “Industrial” sector was the most affected, with a 34-day lag from its average in 2018. This group includes an assortment of infrastructure development, utilities, housing and transportation-related government instrumentalities, industrial development authorities or agencies of a county or a state.

The most resilient sector in terms of filing consistency was the Primary and Secondary Education sector, slipping only by 6 days from its average in 2018. School district finances are usually tightly regulated at the State level. Their reporting requirements are tied to state and federal funding levels, thereby providing a clear incentive for those issuers to provide timely disclosure.

The backsliding in 2019 was a bit of a headscratcher, to be sure. For GASB-reporting entities, one may point to the initial difficulties in implementing various new GASB standards, particularly GASB 75 on OPEB liabilities. For most issuers,this standard didn’t kick in until FY2018. However, that still doesn’t explain why certain non-GASB compliant entities, such as New Jersey local units which use the statutory basis of accounting, continue to be disclosure laggards.

Overlapping financial reporting dependency may also be a contributing factor to the latency spread across sectors. A primary government unit’s failure to deliver its disclosure submissions on a timely basis will generate a negative chain reaction for the sub-entities or so-called component units that depend on such disclosure for their own submissions.

Full transparency will be key

Any discussion about municipal disclosure timeliness now seems insignificant in the face of the ongoing global health care tragedy. Given state and local governments’ more pressing humanitarian concerns, further slippage in reporting timeliness should be expected for the balance of this year. Yet, when we come out of this crisis, and we certainly will, let us hope that disclosure will not once again take a back seat to more pressing fiscal concerns.

More than ever, full transparency will be critical in helping municipal issuers regain investor confidence and market access as they recover from the current fiscal disaster. A resumption of the improving MCDC compliance trend documented in this article would be a great start.

DPC DATA is the market leader in muni bond information and disclosure data, and we closely follow trends in municipal bond disclosure. Follow us on Twitter @MuniGUARDNews for the latest muni news and trends.

Author: Triet Nguyen

Contributors: Ina Isabelle Godoy, JJ Munsalud, Ariel Ariola

Get the latest advances in your inbox!

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.