Resources

MuniCREDIT Insights | Identifying Your Muni Portfolio’s Climate Risk Exposure

Even as our collective hearts go out to the victims of Los Angeles area wildfires, many investors are scrambling to identify their portfolio’s exposure to the issuers affected by this latest disaster. DPC DATA’s MuniCREDIT Mapping solution can help.

Barely a few weeks into the new year, the municipal market already has to contend with a massive climate-related event with far-reaching economic and market consequences: the Los Angeles area wildfires. Even as our collective hearts go out to the victims of this unprecedented human tragedy, many investors are scrambling to identify their portfolio’s exposure to the issuers affected by this latest disaster.

The first reaction would be to identify affected issuers based on geographical location, an approach that would prove inadequate given our market’s complex credit structure, where “obligors” and issuers may not be the same entity. DPC DATA’s MuniCREDIT Mapping solution can fill such a gap by identifying credit relationships between municipal obligors and linking them to the relevant climate risk scores, thus providing investors with a full picture of their credit exposure to climate events.

The Market’s Reaction to Date Has Been Severe

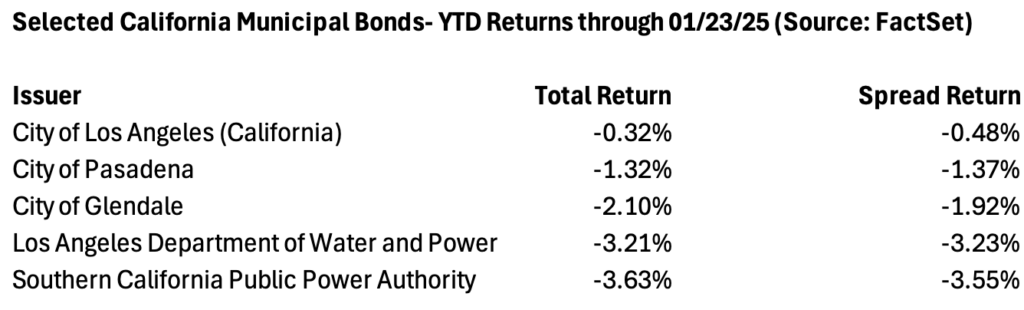

Historically, the municipal market has been able to shrug off any credit fallout from climate disasters, but apparently not this time. The L.A. Fires mark the first time price levels for affected issuers are significantly impacted, as shown by the year-to-date (YTD) total return data from our friends at FactSet in Table 1. FactSet’s performance attribution isolates the return component that is due solely to spread widening, the “spread return”.

Source: FactSet

Clearly, the market’s response has been quite punitive, particularly with regard to the local municipal utilities, such as the Los Angeles Department of Water & Power (LADWP) and the joint action agencies to which LADWP belongs as a member (e.g., the Southern California Public Power Authority (SCPPA)).

For context, the YTD total return for the S&P Municipal Bond Index return through 1/23/25 was basically flat, at -0.17%. Thus, the negative return is attributable primarily to credit concerns, not general market movements.

If you happen to own some of the longer-duration maturities, your bond’s underperformance has been even more dramatic than shown above. For instance, the LADWP Waterworks Revenue 5.00% 07/01/34 showed a negative spread return of -5.58%. The SCPPA Revenue 5.00% 7/01/35 fared even worse, with a spread return of -6.17%.

“Base Obligor” vs “Direct Obligor”

A big part of our MuniCREDIT Mappings’ usefulness for portfolio risk management purposes comes from the distinction we make between “base” and “direct” obligors (for the complete white paper on our obligor mapping methodology, please contact us at research@dpcdata.com).

A “Direct Obligor” is the legal entity directly responsible for paying the debt or the revenue stream from which debt service is paid, as distinct from the Bond Issuer.

A Direct Obligor can be:

- A Governmental Unit or Non-Profit Entity

- An Enterprise Fund of a Governmental Unit

- A Dedicated Tax or Revenue Stream

- A stand-alone, no recourse Project

- A Private Corporate Guarantor

What about the “Base Obligor”? This is an innovative concept we use to link related Obligors in a Parent/Child relationship. Any number of Direct Obligors can be linked to a Base Obligor, based on any combination of the following factors:

- Legal status

- Economic dependency

- Financial Accounting basis (e.g., component units or enterprise funds of a primary government)

- Disclosure Requirements

For any bond issue, if the security pledge is a general revenue pledge (e.g., “General Obligation, Full Faith & Credit, etc.), then the Obligor is both the Base and the Direct Obligor. If the security pledge is a specific revenue pledge, then the Base Obligor will be different from the Direct Obligor, with the latter being the actual pledged revenue stream.

Identifying Your Exposure to Any Single Obligor

DPC DATA users can easily integrate our MuniCREDIT Mapping data into their security master by simply matching their security holdings’ CUSIPs. Once this is done, the user can quickly identify and aggregate his or her exposure to any single obligor, including any indirect exposure through conduit issuers.

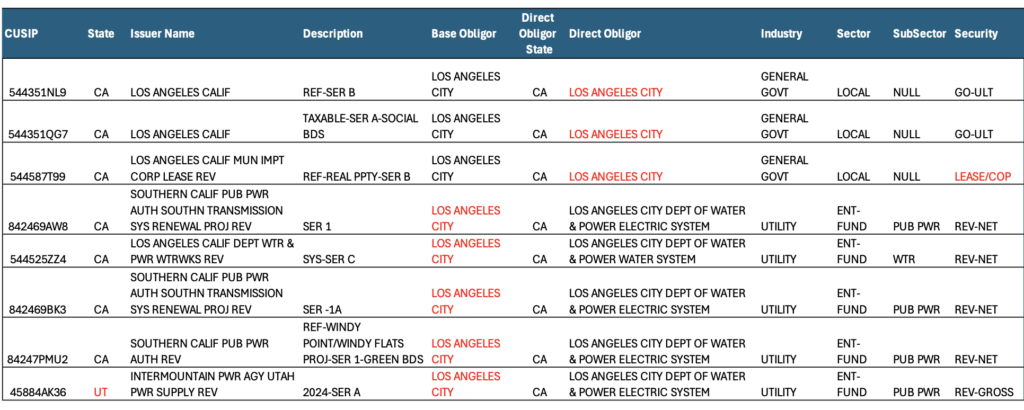

In the case of the City of Los Angeles (L.A.), users can just screen their holdings for issues that are linked to the City of Los Angeles as either a “base obligor” or a “direct obligor”, as displayed in Table 2 (Note: this is only a sample set, not a comprehensive list of all issues with L.A. exposure).

While the first two General Obligation issues (linked at the CUSIP 9 level) are fairly straightforward, the rest of the list is not quite as obvious.

In the case of the Los Angeles Municipal Improvement Corp. deal, the City of L.A. is correctly identified as the lessee in this lease transaction.

Of course, the entity that has been of greatest concern to market participants is the local utility, the Los Angeles Dept of Water and Power (LADWP), identified here as an enterprise fund of the City as the base obligor. Given the massive local economic impact and the history of “inverse condemnation” applicable to utilities in California, LADWP will be a uniquely vulnerable credit coming out of this climate disaster.

Last but not least, joint action agencies that count LADWP as a major participant are also identified, even those that are located in a different state, such as Utah-based Intermountain Power Agency. Needless to say, a geo-spatial approach would have completely missed this type of relationship.

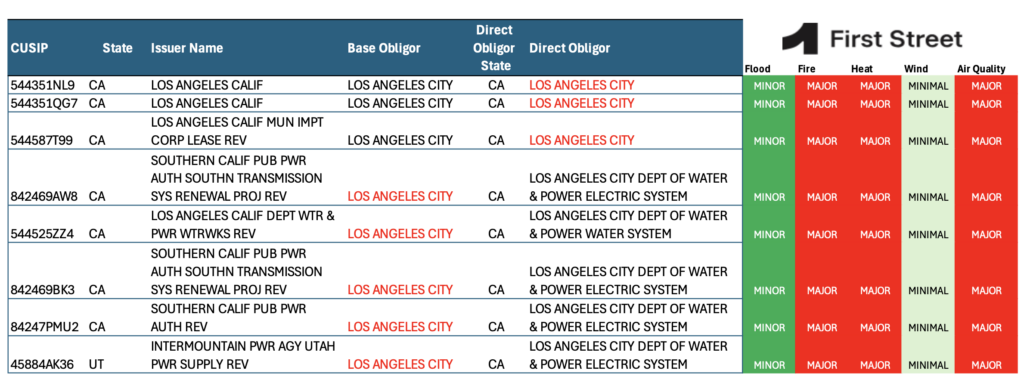

Climate Risk Exposure Further Mapped

All L.A. related obligors identified above are mapped to climate and environmental risk scores provided by our partners at First Street, a best-of-breed climate financial risk modeling firm. The risk scores assigned to the city of L.A. by First Street are shown in Table 3. Note that these scores date back to last summer and they certainly have proven to be quite prescient.

Conclusion

The Los Angeles wildfires may prove a turning point in driving home the need for municipal bond investors to (1) acknowledge climate risk exposure as a significant component of overall credit risk; and (2) correctly identify the climate risk exposure in their portfolios, not just to the latest disaster, but the next potential event. Of course, different areas of the country may be subject to different types of physical risk. DPC DATA’s MuniCREDIT Mapping solution, integrating forward-looking climate risk scores from First Street, offers a comprehensive risk management tool for all pro-active municipal market participants.

Note: for more details on our MuniCREDIT Solutions, which covers over 29,000 municipal obligors across all major sectors, and our MuniCLIMATE solutions, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.