Resources

MuniCREDIT Insights | Health First Obligated Group: Margin Pressure from Rising Labor Costs

In this week’s case study, we look at how Health First navigated through the pandemic environment of the past 3 years.

January 31, 2023

The Health First Obligated Group (“Health First” or “System”) recently accessed the tax-exempt market with $435.645 mm in new bonds, issued through the Brevard County Health Facilities Authority. The new issue included $47.415 mm in the Series 2023A for forward delivery.

In this week’s case study, we take a look at how Health First navigated through the pandemic environment of the past three years.

Rising Pressure on Operating Margins

For the healthcare sector, “2022 was the worst financial year since the start of the pandemic,” according Kaufman Hall’s just released National Hospital Flash Report for January 2023. “Approximately half of U.S. hospitals finished the year with a negative margin as growth in expenses outpaced revenue increases.”

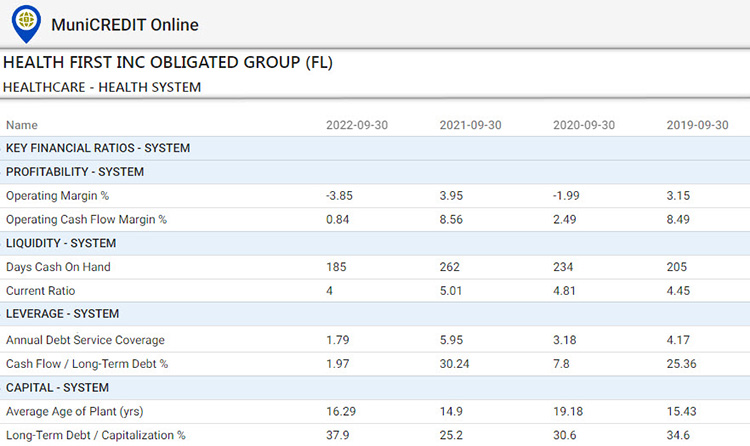

Health First was no exception to the rule, as a quick check of key financial trends and ratios through our online application, MuniCREDIT Online, shows:

Key takeaways from Table 1:

- Operating Margin turned negative in FY2022 (-3.85% vs 3.95% in FY2021). Similarly, Operating Cash Flow Margin turned razor thin in FY2022 (0.84% vs 8.56% in FY2021).

- Days Cash On Hand (DCOH) also deteriorated to 186 days, compared to 262 days in the prior fiscal year.

- Annual Debt Service Coverage clocked in at only 1.97x in FY2022, vs 5.95x in FY2021.

By most, if not all, financial measures, the System took a turn for the worse in FY2022.

Labor Cost Pressure

The Kaufman report attributed much of the industry’s margin deterioration to “prolonged increases in labor expenses last year. The increases were driven in part by a competitive labor market, as well as hospitals needing to rely on more expensive contract labor to meet staffing demands.”

Health First’s Compensation and Benefits Expenses (included in our data collection template) increased by 24.7% between FY2019 and FY2022, while Operating Revenues only grew by 11.5% over the same period. More importantly, the rate of labor cost increase also accelerated: +3.03% in FY2019, +7.8% in FY 2021 and +12.2% in FY2022. It comes as no surprise that labor expenses now account for 42% of total operating expenses.

Longer Average Length of Stay (ALOS) was also a contributor to declining margins as our data show ALOS rising to 4.84 days in FY2022, compared to 4.3 in FY2019.

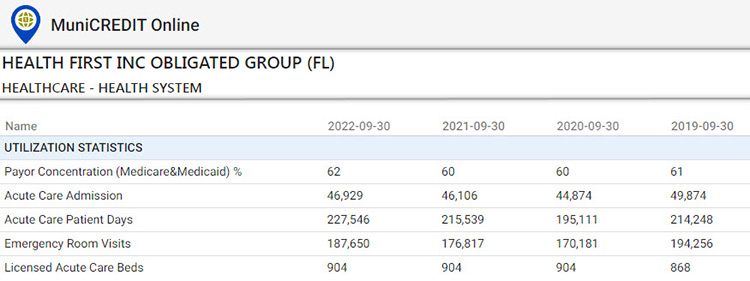

Payor Mix Risk

Health First’s payor mix shows significant dependence on Medicare (54% of gross patient revenues) and Medicaid (8%). This may introduce some degree of vulnerability to potential changes in Medicare funding as a result of the ongoing debt ceiling showdown and a general cost-cutting mindset from the new Congress.

Table 2 displays some key operating indicators for the System.

ESG Considerations

Healthcare organizations have become prominent targets for cybercrime due to the sensitive nature of their database. Luckily, Health First has not reported any cybersecurity incidents over the past year. The System has in fact adopted the National Institute of Standards and Technology Cyber Security Framework and has hired a third-party vendor to perform annual enterprise security risk assessments.

The System also maintains cybersecurity liability coverage, consisting of a $1 mm self-insured retention and $20 mm of excess insurance. This, of course, brings up the ongoing debate about whether disclosure of such coverage might actually put a target on the System’s back.

Conclusion

The above comments are certainly not intended to be a comprehensive credit analysis of the Health First Obligated Group. However, they serve to highlight the fact that MuniCREDIT Online users can gain a very quick understanding of the financial issues facing this and most other health systems during and after the pandemic environment.

Even though 2022 was a difficult year for the entire sector, with many issuers reporting covenant breaches, the ratings agencies have so far refrained from taking drastic rating action, opting to give issuers the benefit of the doubt. This may change as we head into the new fiscal year and into a less benevolent fiscal environment at the federal level.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.