Resources

MuniCREDIT Insights | Federal Funding Risk at Private Universities

The Higher Education sector is without a doubt among the most credit-challenged sectors at the moment. Still recovering from the impacts of the pandemic, the sector is now navigating new federal policies that tie compliance with certain requirements to the awarding of federal contracts.

The poster child for this latest crisis is Columbia University, accused of antisemitism for its handling of the recent on campus pro-Palestinian demonstrations. A few weeks ago, the federal government reportedly canceled $400 million in contracts with the school, with more to come should Columbia not comply with governance changes demanded by federal authorities.

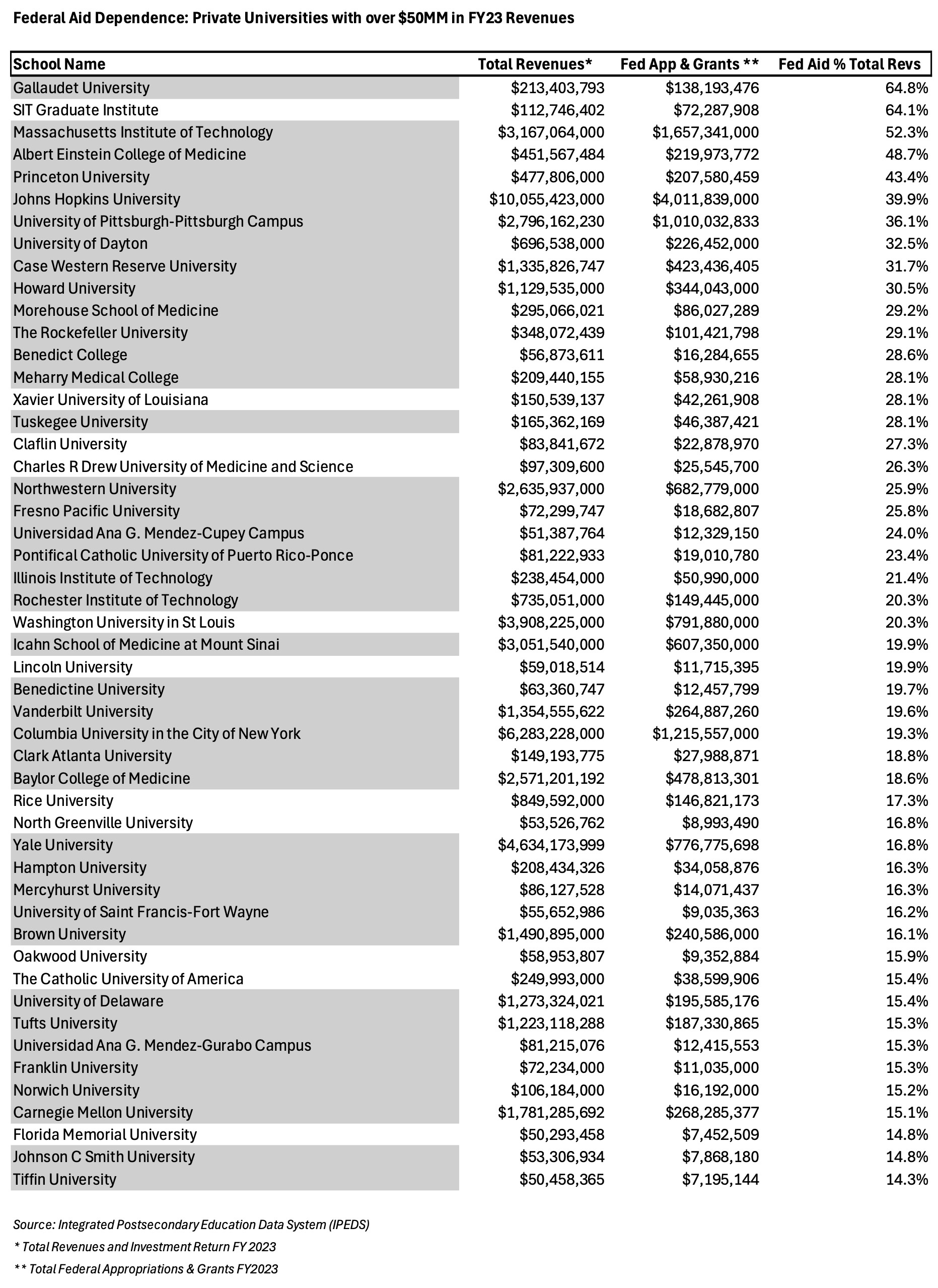

Aside from Colombia University, which other private institution might be vulnerable to potential cuts in federal aid? Using the most recent dataset available from the Integrated Postsecondary Education System (“IPEDS”), we’ve compiled a list of private colleges and universities who are the most dependent on federal funds, either through federal appropriations or through federal grants and research contracts.

For the purpose of this analysis, we limited our universe to institutions with at least $50 million in total revenues in FY2023. Institutions that are current or former tax-exempt bond issuers are shaded in grey.

Table 1

On the list are several major institutions with a significant presence in the municipal bond market, from the Massachusetts Institute of Technology (“MIT”) to Princeton and Johns Hopkins, to name a few. Several of these schools have already been targeted by the Trump Administration for antisemitic activities, notably Johns Hopkins, Northwestern and of course, Columbia.

Several of these universities are also major employers in their respective cities (e.g. Johns Hopkins in Baltimore) and any cutback in employment from these entities will also significantly impact their local economies.

Finally, private colleges with substantial endowments may also be affected by the ongoing discussion regarding the preservation of the tax exemption for private activity bonds.

Concerned about this sector? For a more in-depth analysis of any of the institutions mentioned above, our MuniCREDIT Solutions offers access to comprehensive financial and operating data for over 550 private universities, including the IPEDS dataset (research@dpcdata.com )

Note: for more details on our MuniCREDIT Solutions, which covers over 28,000 municipal obligors across all major sectors, and our MuniCLIMATE solutions, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.