Resources

MuniCREDIT Insights | Municipal Utilities: Enterprise Funds versus Stand-Alone Entities

Reviewing Charleston Waterworks & Sewer helps us illustrate a unique feature of MuniCREDIT Mapping: the distinction between enterprise fund and stand-alone entities, and how it may apply to capital structure mapping and ESG scoring.

August 30, 2022

The City of Charleston, SC, Waterworks & Sewer System, came to market back in June with a $151.19 mm Capital Improvement Revenue Issue. With an Aaa rating from Moody’s and AAA from S&P, there is little concern about the credit at this time, however, we want to use it to illustrate a unique feature of our proprietary MuniCREDIT Mapping solution: the distinction between enterprise fund and stand-alone entities, and how it may apply to capital structure mapping and ESG scoring.

Financials

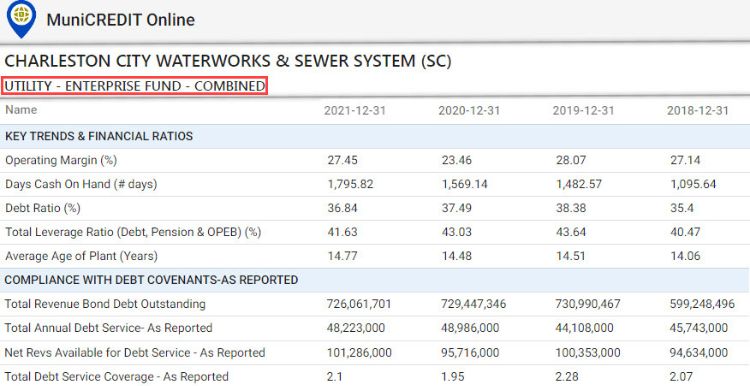

This combined water and sewer system does indeed display very solid financial indicators, as shown in Table 1.

Charleston Waterworks & Sewer scores well on most key financial ratios: solid operating margins, ample liquidity (almost 1,800 Days Cash On Hand) and moderate leverage (including pension and OPEB liabilities). Its debt service coverage ratio, as reported by the utility itself, has been holding steady around the 2.00x mark, comfortably above its rate covenant of 1.20x.

A note about debt service coverage calculations: the formula for computing debt service coverage and other rate covenants can vary significantly from one bond indenture to the next. The data we collect allow our users to calculate debt service coverage ratios using a standardized formula for easy comparison with other similar utilities. We also collect debt service coverage ratios on an “as reported” basis whenever available, to show actual compliance with the specific bond indenture.

Enterprise Fund Utilities versus Stand-Alone Utilities

The reader may notice from Table 1 that we have classified Charleston Waterworks & Sewer as a “Utility/Enterprise Fund/Combined.”

As you know, municipal utilities generally fall into two broad categories in terms of governance: (1) true stand-alone utilities who are self-governed; and (2) those who are treated for financial reporting purposes as an enterprise fund of their primary local government. Being able to identify the latter category may be important from an analytical perspective, because enterprise funds are part of, and thus should be rolled up into, the capital structure of the primary government they belong to.

DPC DATA’s obligor mapping methodology uses the Direct Obligor vs Base Obligor concept to link enterprise funds and/or component units to their primary governments. In the case of utilities, an enterprise fund utility would be classified as a Direct Obligor for any bond issue, with the host government acting as the Base Obligor.

A “stand-alone” utility would be both a Direct Obligor and its own Base Obligor, since it’s neither a fund nor a component unit of another governmental entity.

ESG Considerations

The distinction between stand-alone and enterprise fund utilities may come in handy when one tries to design an Environmental Risk scoring system for municipal utilities.

An enterprise fund utility should share the same climate risk profile as its primary government. In most instances, its service area will be coterminous with the city it serves. While the system’s carbon footprint will be determined by the nature of its facilities (e.g., solid waste facilities usually have much higher carbon emissions), its carbon transition policy will be controlled by the primary government.

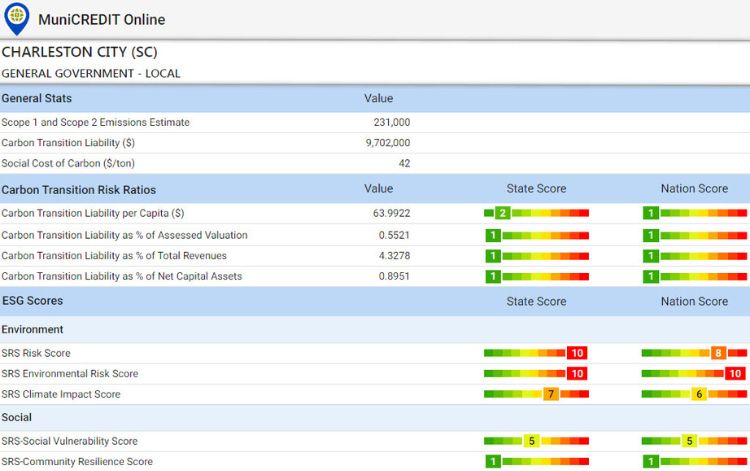

In the case of Charleston, our user can look up the MuniESG profile for the City itself in our MuniCREDIT Online application:

In contrast to its financial profile, Charleston’s ESG profile is quite polarized, with extremely high “Environmental Risk” (score of “10”, or highest decile) and extremely favorable “Carbon Transition Risk” ratios (score of “1”, or lowest decile), compared to other cities within South Carolina and across the nation.

In the official statement for the Series 2022 issue (pages 36 & 37), the City does acknowledge its potential climate change and cybersecurity exposures, but in the vague stock language typically found in recent bond offerings. Ideally, it should produce a detailed assessment of the environmental risks it faces and the specific steps it is taking to address those risks. Such disclosure will certainly be more than welcome by market participants.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.