Resources

[VIEWS] Five Municipal Market Trends to Watch in 2021

DPC DATA's Triet Nguyen shares his views on key municipal market trends for 2021. If 2020 taught us anything, says Nguyen, it would be “expect the unexpected.”

Happy new year. Here we are again, going through the annual ritual of trying to divine what may transpire over the next twelve months. If 2020 taught us anything, it would be “expect the unexpected.” At an industry conference in midtown Manhattan in February of last year, a panel of market experts could not come up with any downside scenario for the municipal sector, even going so far as to dismiss the ongoing public pension funding crisis as “manageable.”

Famous last words. Within a few weeks of that gathering, the pandemic hit, and the tax-exempt sector went through an unprecedented period of volatility. Fortunately, the crisis drew a quick and forceful response from the Federal Reserve, primarily through the establishment of a backstop Municipal Liquidity Facility (MLF).

Although the MLF was only tapped by the most distressed municipal issuers (namely, the State of Illinois and the New York Metropolitan Transportation Authority), it acted as powerful “signaling tool” which calmed the market and brought liquidity back to the sector by the end of May. The market never looked back from that point on, with municipal supply reaching another record level of $474 billion for the full calendar year.

So, what might 2021 have in store for us? From the perspective of a data and compliance solutions provider, we’ve identified five key trends to keep an eye on as the year unfolds.

#1 Has the municipal market really dodged the credit bullet from the pandemic?

As the pandemic unfolded last year, state and local governments found themselves caught in the political crossfire. As you may recall, one of the key obstacles to the second financial rescue package after the CARES Act was state and local government aid, with Republicans unwilling to let what they perceive as “poorly managed” states use Covid-19 funds to fix their pre-existing structural budget problems.

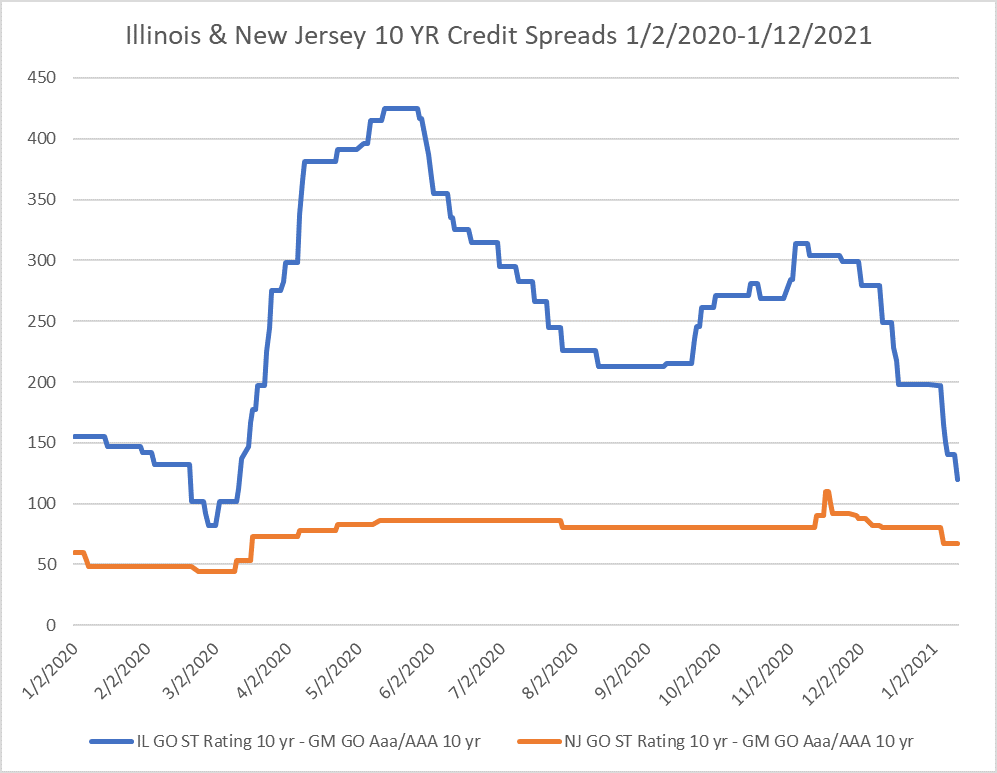

With the advent of a new Democratic administration and a razor-thin Democratic majority in the Senate, municipal market participants have breathed a sigh of relief. They point to strong local housing markets and robust sales tax collections (bolstered by a 2018 Supreme Court decision allowing online sales taxation) as evidence of the public sector’s resilience. In fact, if credit spreads on perennially stressed issuers such as the State of Illinois are any indication (see graph below), state and local finances are already on the mend, at least according to the current consensus.

Source: Refinitiv

Not so fast, we say. While we recognize that the market has successfully dodged the liquidity bullet, courtesy of an aggressive Federal Reserve, the credit story is far from over. President Biden’s fiscal stimulus package is still quite a way from getting passed in its current form. State and local governments themselves have complicated the narrative by reporting revenue collections that have come in well above admittedly over-pessimistic projections.

“The long-term structural effects of the pandemic on certain public sectors have yet to manifest themselves.”

Although the stock market’s amazing rebound has allayed early fears about the asset side of most public retirement systems, many state and local governments actually reduced their pension contributions last year, potentially jeopardizing future funding levels.

Furthermore, the long-term structural effects of the pandemic on certain public sectors have yet to manifest themselves. Think about factors such as mass transit, commercial real estate in major cities, suburban flight, and inter-state migration patterns, just to name a few.

Regardless of how much federal assistance will be forthcoming this year, we believe sector selection will be a key determinant of investment performance for investment grade portfolios.

#2 Will the growth in taxable municipals help enhance liquidity in the market?

Pandemic or not, the taxable municipal sector continued to surge in 2020, rising from about 10% of the total municipal supply to as much as 40%, according to Citigroup. This was, of course, the continuation of a trend that started with the removal of tax-exempt advance refunding in 2017, which forced many issuers to refund through the taxable market instead.

Looking ahead, prospects for the restoration of tax-exempt advance refunding may look brighter under the new Administration, which may curtail further growth in taxable supply. This could, however, be offset by a new infrastructure funding program similar in characteristics to the old taxable Build America Bond or “BABs” program.

The rise of taxable municipals, if sustainable, should result in an expansion of the demand side of the market, by bringing in more corporate bond investors and more foreign investors (this, as you may recall, was also the initial promise of the BABs program, which unfortunately proved short-lived).

The expanded audience for municipals may have different requirements than the traditional buy-and-hold muni investor: less tolerance for callability features, more emphasis on larger, index-friendly issues and greater sensitivity to credit changes. As we all know, tax-exempt paper is practically unhedge-able, forcing traditional investors to be long both credit and duration at all times. In contrast, taxable municipals are hedge-able through the Treasury market, which allows for pure credit plays.

“The growth in taxable municipals may also potentially reverse the trend of shrinking liquidity in the sector.”

The growth in taxable municipals may also potentially reverse the trend of shrinking liquidity in the sector. For various reasons, the active municipal market has become a retail-oriented, odd lot market. Large block trades of the kind seen in the early days of the mutual fund boom have grown more and more infrequent.

Investors who trade taxable municipals can actively trade in and out of various fixed-income sectors based on relative value. One hopes that, absent the desire to hang on to a tax-advantaged instrument as long as possible, they may exhibit a greater propensity to trade and thus inject more liquidity into the market.

In all probability, we’ll continue to see a split market, with buy-and-hold investors and their proxies (mutual funds, etc.) hanging on to tax-exempt paper on one side, and a more actively traded taxable sector on the other side involving more non-traditional buyers.

From a disclosure standpoint, we also should point out the MSRB’s EMMA site does not currently accommodate muni issues with corporate CUSIPs, thus relegating them to a kind of disclosure no man’s land.

#3 Will the pandemic lead to changes in disclosure practices from municipal issuers?

As a provider of compliance and disclosure solutions, we kept a keen eye on any potential change in issuer disclosure practices as the industry went through the first few months of Covid-19 crisis. As the healthcare crisis unfolded last spring, the SEC and the MSRB encouraged issuers to be forthcoming with their creditors about the potential financial impact of the pandemic, even overcoming their reluctance to make forward-looking statements.

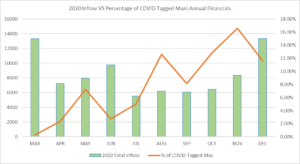

Apparently, quite a few issuers took them up on it in 2020. The proportion of Muni Annual Financial disclosure filings related to Covid-19 has in fact been on a rising trend, based on DPC’s data, as shown in the graph below.

Source: DPC DATA

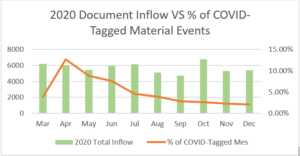

In contrast, Covid-related Material Events disclosures as a percentage of total disclosure filings peaked in April 2020 and has been on declining trend since, as shown below.

Source: DPC DATA

In all fairness, this declining trend could partially be attributed to DPC’s own methodology for tagging Covid-19 related disclosure items. The MSRB’s weekly Covid-19 report appears to mechanically tag any document that makes any reference whatsoever to the pandemic, which may run the gamut from the mundane (“our staff will be working from home”) to the serious (“we may miss the next coupon because of the pandemic”).

In contrast, our analysts actually read the documents to make sure that they in fact contain material information. They also scrutinize items filed under the much-abused “Other” category and try to re-categorize them into more specific categories.

“The jury is also out on whether issuers have gained some degree of comfort with a new disclosure regime that actually addresses the investors’ needs for more up-to-date information.”

All in all, the incidence of severe credit-related material events seemed quite modest, at least through the month of December. As we discussed earlier, it remains to be seen whether the pandemic will have a lagged effect on muni issuers’ financial results over the next few months. The jury is also out on whether issuers have gained some degree of comfort with a new disclosure regime that actually addresses the investors’ needs for more up-to-date information. In a market where financial disclosure can be as much as 24 months out of date, such an attitudinal change would be nothing short of revolutionary.

#4 Will Environmental, Social and Governance (“ESG”) factors finally impact municipal bond performance?

It’s fair to assume that under the new Biden Administration and against the backdrop of the current health care crisis, ESG-oriented strategies will have the wind at their back this year.

In the municipal market, however, ESG continues to be a great marketing strategy in search of an investment strategy, even though public finance projects are almost by definition environmentally or socially “impactful”. Many investment boutiques had great success marketing a “Do Well by Doing Good” investment theme. Alternative non-financial data sources have also proliferated. Yet, the actual impact on investment performance has been hard to discern. In fact, the S&P US Municipal Green Bond Index returned 4.58% in calendar year 2020, slightly underperforming the broader S&P Municipal Bond Index, at 4.95%.

“In the municipal market, ESG continues to be a great marketing strategy in search of an investment strategy.”

In our view, the industry needs to overcome two key hurdles before ESG strategies can reap a performance edge over traditional strategies: (1) the establishment of a common set of standards or best practices for ESG data and (2) acceptance of a common ESG “performance” benchmark, perhaps through a widely accepted scoring methodology. To elaborate on the second point, if all market participants have their own proprietary ESG scoring system, it would be impossible for anyone to “monetize” ESG outperformance. One person’s great ESG investment may not necessarily be another’s, and the “market” would not be able to reward or penalize any bond issue in terms of yield in the absence of a common benchmark.

A widely adopted ESG scoring system would, in effect, perform the same function as the credit ratings provided by the rating agencies. Each market participant may still have their own internal credit rating system, but they need a widely accepted rating system to agree or disagree with, and to trade against. For instance, if portfolio manager X thinks bond Y is improving toward “A” quality versus a current Moody’s rating of “Baa”, any outperformance due to her credit foresight won’t be captured until Moody’s upgrades the bond (or until the market recognizes the upgrade is forthcoming).

The obvious question at this point would be: why not just let the rating agencies come up with their own ESG scores and use those as the common benchmark? Our main concern would still revolve around the agencies’ issuer-pay business model, which may detract from a truly objective ESG assessment of their own clients. The ideal solution, in our view, would be a user-pay scoring system driven entirely by objective data.

Climate change is the one area of ESG where there appears to be some degree of market consensus, primarily because it’s a demonstrated credit risk factor, with a clear connection to local tax bases and local infrastructural financing needs. Under the new Administration, we would expect the regulatory authorities to start ramping up their scrutiny of climate change exposure and disclosure for all market participants. Municipal issuers have already started to include both climate change and cybersecurity disclosure language in their primary offering documents and we would expect financial advisors will soon be required to make such disclosure to their clients going forward.

#5 Will the availability of new reference and fundamental credit data finally spur technological innovation?

Trying to predict the pace of technological innovation in a market so wedded to tradition is always a dicey proposition. This year, however, we find reason to be somewhat more optimistic. As we’ve pointed out in past articles, when it comes to technology in municipals, the elephant in the room has always been the lack of a credit reference framework that reflects the fragmented nature of the asset class. DPC DATA’s new Obligor/Sector Mapping methodology is designed to address this critical need in the municipal market, and we look forward to engaging with key market participants in developing innovative use cases for the new fundamental credit data. Some of those use cases may include pricing, index structuring, automated bidding, and credit scoring, among others.

“2021 could be the year the municipal market finally puts in place the technological foundations for its growth into an international asset class.”

If 2020 was the year the municipal market proved its resilience, 2021 could be the year this unique asset class finally puts in place the technological foundations for its growth into an international asset class. Regardless of what may ultimately transpire, the new year promises to be an exciting one.

Municipal market trends and other research

As always, we wish you all a happy, safe, and hopefully prosperous, year. If you like this municipal market trends article and wish to get the latest news and insights from DPC DATA delivered right to your Inbox, you can subscribe here.