Resources

MuniCREDIT Insights | Clyde, TX: When Credit Risk and Climate Risk Converge

On August 15, the City of Clyde, TX, defaulted on the August 1 bond payments for its series 2013B and series 2022. The City blamed severe drought conditions affecting its water and sewer system operations as the cause for the default. We take a closer look at Clyde’s fiscal position and climate risk profile to see if their claim holds water.

On August 15, 2024, the City of Clyde, TX, defaulted on the August 1 bond payments for its series 2013B and series 2022 and made an unscheduled draw from its bond insurance policies, issued by Assured Guaranty and Build America Mutual. While the bondholders will be made whole by the bond insurers in this case, the City blamed severe drought conditions affecting its water and sewer system operations as the cause for the default.

Could this be the first climate change-related municipal default? We take a closer look at the City’s fiscal position and climate risk profile, using DPC DATA’s various disclosure and credit research applications.

Disclosure

To start, users of our MuniGUARD Monitor application were alerted to a new Material Events notice from Clyde, under “Principal and Interest Payment Delinquencies Unscheduled Draws on Credit Enhancements Reflecting Financial Difficulties.” Here is what the City reported as the cause of the default:

“Such draw is unscheduled and reflects financial difficulties of the Issuer, including without limitation financial difficulties resulting from increased costs related to operations and maintenance of the Issuer’s waterworks and sewer system (“System”), as well as decreased “Surplus Revenues” of the System, which are pledge to payment of the Obligations (…).

In the Issuer’s fiscal year 2023—following implementation of Stage 2 Watering Restrictions, the Issuer’s water sales decreased by approximately 7 million gallons as compared to the Issuer’s 2022 fiscal year, resulting in decreased System revenues. On August 1, 2024, the date of the default described above, the Issuer issued a notice entitled “Stage 3 Response – Severe Water Shortage Condition (Water Emergency)”, with a stated goal of achieving a 30% reduction in daily water demand.”

Financial Summary

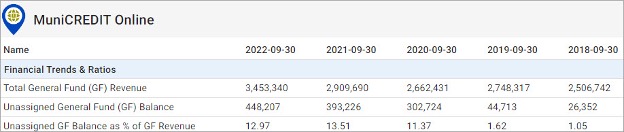

Was there any financial basis for the default? Through our MuniCREDIT Online application, one can quickly gauge key financial trends for Clyde, as follows:

At first blush, the City appears to have maintained a healthy unassigned General Fund balance over the past three years through FY2022 (Note: the absence of FY2023 financials at this late date is the first credit red flag).

Table 1:

For the Combined Governmental Activities Funds, the picture looks quite different, with the City experiencing declines in its Net Position (i.e., net operating deficits) in three out of the last five fiscal years.

Table 2:

But the real source of credit strain lies in the debt burden, with the City’s Net Direct Debt per capita having more than doubled since FY2020. Total Debt Service as a percent of Total Governmental Activities Expenses also rose to 10% vs 5% in FY2020.

Table 3:

As for the reported cause of the default, the City’s Water, Sewer & Sanitation Fund showed Net Operating Income of $558,992 in FY2022, resulting in debt service coverage of 0.99x. Stressed, yes, but certainly not dire. One can assume that utility operations deteriorated further in FY2023, but that’s just speculation in the absence of a FY2023 audit.

Climate Risk Factors

Was climate change to blame? Users of our MuniCLIMATE Solutions can easily check an obligor’s financial status and climate risk exposure, all on the same platform.

In Clyde’s case, our partners at Spatial Risk Systems (SRS) currently rate the City’s Heatwave score at 4 (out of 10) versus other towns in Texas, and also versus all cities in the US. Since the SRS scores takes into account Expected Annual Losses (EAL), the relatively modest EAL for a small city such as Clyde partially offsets the high probability of Heatwave occurrence, resulting in a more moderate overall score than one would expect.

First Street, whose climate risk scores are also available through DPC Data, confirms the City’s Heat Factor risk as “major”, with all 1848 properties in the City at risk. Other climate factors, such as Flood, Fire, and Wind are, fortunately, quite minimal for this community. First Street’s scores are forward-looking and incorporate the projected path of climate risk factors between now and 30 years from now.

Comments

- It would not be correct to blame the City of Clyde’s default solely on climate factors. The City’s history of operating deficits and the huge increase in its debt load since 2020 are equally to blame.

- This does lend credence to the claim that climate risk can have the greatest impact on declining credits or credits with limited resources. It further shows that climate risk should be an integral part of the credit analysis process.

- The severe drought conditions were disclosed as far back as 2020, but apparently did not affect the city’s ability to obtain an “A-“ unenhanced rating from S&P and its ability to qualify for bond insurance.

- The City notably chose to default only on its double-barreled debt, which are secured by both a GO pledge as well as from net revenues of the water & sewer system, but not on its regular GO debt. If upheld in court, this would turn traditional credit analysis on its head: in a double-barreled situation, most credit analysts would view the GO pledge as the ultimate backstop versus the enterprise revenue pledge.

- The City’s refusal to tap its tax revenues is, at a minimum, very questionable. We’re quite certain Standard & Poor’s (S&P), as well as the bond insurers, relied heavily on the GO pledge instead of the revenue pledge when making their initial rating and credit enhancement decisions. This is why S&P downgraded the City’s GO bonds all the way from “A-“ to “B”, even though the GO bonds are still current. There is clearly a “willingness to pay” issue here.

- It would appear the City chose the double-barreled debt so it can blame drought conditions and their effect on the utility system’s financials. If true, this might be the first time an issuer uses climate change as an excuse for poor fiscal management.

- Finally, for those investors who still think climate change lies too far into the future to worry about, we note that the City’s Series 2023 bond issue contains a 2053 maturity. There is certainly ample time for climate change to have an impact on those bonds.

Note: for more details on our MuniCREDIT Solutions, which covers over 28,000 municipal obligors across all major sectors, and our MuniCLIMATE solutions, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.