Resources

Market Discount Cut-Off Price for De Minimis Tax Rule Available in MuniPOINTS

A critical but seldom-used data element featured in MuniPOINTS has been getting attention lately and it’s all because of an obscure IRS tax rule.

As the Federal Reserve and bond market push interest rates higher, bond prices continue to decline. But when bond prices fall to a certain level, the so-called de minimis tax rule kicks in, influencing relative price valuations and market liquidity. (See the recent Bond Buyer article and Brookings Municipal Finance Conference paper.)

The de minimis rule sets the threshold price below which gains on a discount bond will be taxed as ordinary income rather than a capital gain, potentially reducing the investor’s after-tax return.

The rule states a discount that is less than a quarter-point per full year between its time of acquisition and its maturity is too small to be considered a market discount for tax purposes. Instead, the accretion from the purchase price to the par value should be treated as a capital gain, if it is held for more than one year.

Securities purchased at a price near or below the threshold price may be more vulnerable to negative tax and liquidity implications associated with de minimis.

Pricing insights for a de minimis world

MuniPOINTS users can simply take note of the Market Discount Cut-Off Price for the bond they are reviewing.

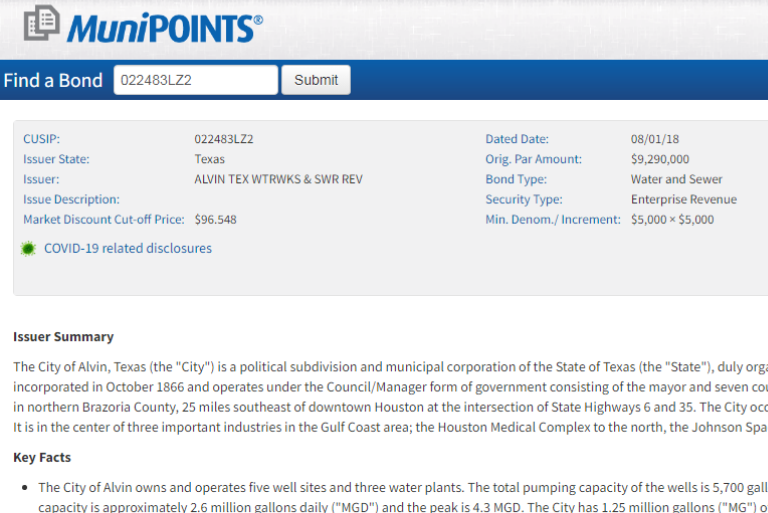

For example, for the ALVIN TEX WTRWKS & SWR REV bond, the Market Discount Cut-off Price is $96.548 (Figure 1). If the purchase price is above $96.548, then any future gain upon sale will be treated as a capital gain and subject to capital gains tax. If it is below this price, future gains will be subject to ordinary income tax.

Figure 1.

The DPC DATA product development team collaborated with industry experts to build this data element. All with the goal of making it easier for MuniPOINTS users to get the insights they need to advise their clients on muni bonds for their portfolios.

If you are a current MuniPOINTS user and would like to see the Market Discount Cut-Off Price on your reports, please let us know by sending an email to sales@dpcdata.com with “Market Discount Cut-Off Price” in the subject line.

The Market Discount Cut-Off Price is an estimate and should not be viewed as investment or tax advice, users should consult their own tax advisor before making any trade or investment decision.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.