Resources

MuniESG Insights | City of Madison, WI: An ESG Story Waiting To Be Told

This state capital is a leader in sustainability efforts, but hides its light under a barrel. MuniESG scoring data illustrates what Madison officials could be disclosing to enhance the city’s reputation.

The City of Madison, WI, is in the market this week with a $14.5 mm Sewer System Revenue Bond issue, Series 2022-D, with a Aa2 rating from Moody’s. As far as we can tell, the Preliminary Official Statement contains no disclosure on ESG factors, except for some standard language on cybersecurity risk. This is a shame because the City is actually a leader in sustainability efforts, as befits its status as the state capital and a major college town.

ESG Disclosure Is Lacking

The City’s ambitious sustainability goals are clearly stated on its Sustainability & Resilience web page:

“The City of Madison is committed to doing our part to reduce greenhouse gas emissions and avoid the worst impacts of climate change. Madison has set the ambitious goal of reaching 100% renewable energy and net zero carbon emissions for city operations by 2030 and community-wide by 2050.”

While the City’s commitment to a green economy is commendable, we believe investors would welcome a more comprehensive ESG disclosure regime, including an initial assessment and identification of ESG risk factors, followed by a discussion of the initiatives or programs undertaken to address such risk factors.

Let’s take a look at the City’s Environmental Risk exposure, using data developed by DPC DATA and our partners at Spatial Risk Systems (SRS).

Physical Risk Exposure

Since the Sewer System is an Enterprise Fund of the City, the reference entity for ESG assessment purposes would be the City itself.

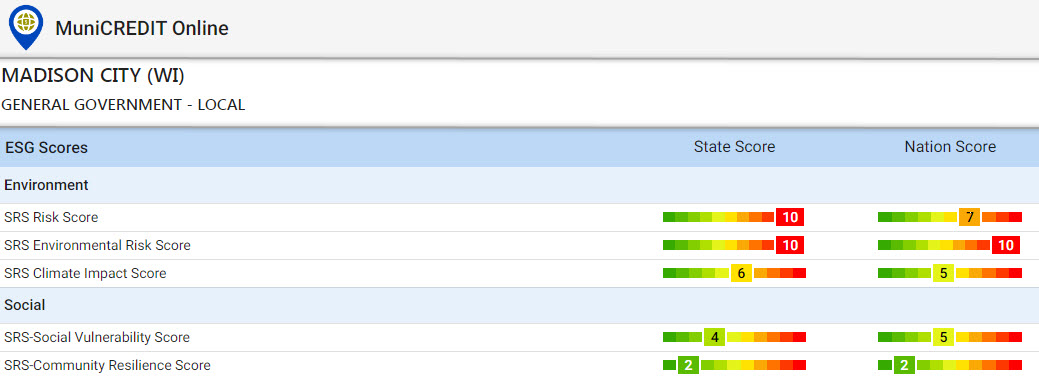

As shown in Table 1, Madison has very moderate Climate Risk exposure, with an overall Climate Impact Score of “5” compared to other cities in the country and “6” compared to other towns in Wisconsin. Its Social Vulnerability and Social Resilience Scores are also healthy, meaning the City is well-positioned from a socio-demographic standpoint to withstand and rebound from any natural hazard or disaster.

As usual, bear in mind that a better-than-expected Climate Impact score doesn’t mean that the frequency of occurrence of a natural disaster is low. The SRS Climate Impact scale takes into account both the probability of occurrence for chronic and acute hazards and the estimated annual loss from such natural disasters.

Aside from Climate Impact, the other component of a municipal issuer’s Physical Risk is its Environmental Risk (not to be confused with the overall “Environmental” umbrella term, the “E” in “ESG”). The SRS Environmental Risk score strictly measures an obligor’s exposure to local pollution, toxic waste dumps, etc. In Madison’s case, this is a potential area of concern, with the City scoring in the worst decile (score of “10”) versus its peers within the State and within the US.

Transition Risk Exposure

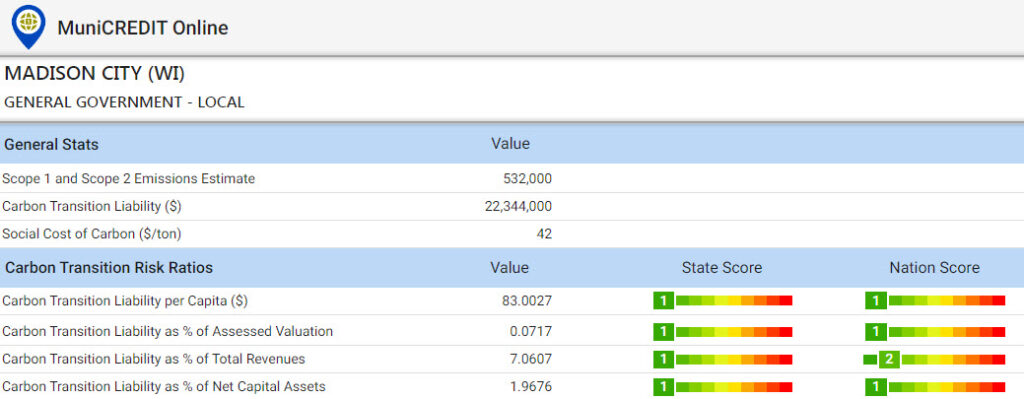

In terms of “Environmental” factors (the “E” in “ESG”), Madison’s strong tax base and ample fiscal resources should help it address any potential costs related to the transition to a net zero economy. The City’s potential carbon transition liability of about $22 million a year looks quite manageable when compared to the size of its tax base (assessed value) and its budget (total revenues). As a result, the County compares quite well with its peers within the State of Wisconsin and ranks in the top two deciles (score of “1” and “2”) versus other cities nationwide, as shown in Table 2.

Conclusion

With a Aaa G.O. rating, the City of Madison already has a great credit story to tell. It could further enhance its reputation in the tax-exempt market by adopting a comprehensive ESG disclosure similar to what we discussed above.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, and on our MuniESG scores, including details on the 18 sub-components of the Climate Impact Score (hurricanes, tornadoes, wildfire, etc.), please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.