Resources

MuniCREDIT Insights | Tracking Debt Service Coverage Covenants: Los Angeles Dept of Airports, CA

We look at the LA airport system to show how MuniCREDIT Online enables credit analysts to efficiently monitor debt service coverage ratios

At a recent public finance conference, one of the speakers expressed his frustration about the difficulty of keeping track of indenture covenant compliance in EMMA. Currently, market participants have to look up individual compliance certificates or continuing disclosure reports (CDR) on EMMA to track whether a particular issuer is in compliance with its indenture-required covenants, particularly with respect to annual or maximum debt service coverage ratios (DSCR). It’s a rather cumbersome task to determine the trend of such coverage if one has to flip from one annual document to the next.

This problem is addressed in our web-based MuniCREDIT Online (MCO) application, which allows users to quickly see the historical trend of DSCR on an “as reported” basis. That is, based on deal-specific debt service coverage covenants.

Standardized vs “as reported” Debt Service Coverage

In our MuniCREDIT Solutions database, we collect all DSCRs, as reported by the issuer, if available. It’s understood that the “as reported” coverages reflect the issuer’s understanding of its compliance obligations under the bond indenture. Our MCO app also provides DSCR computed based on a standardized formula, to allow for cross-issuer comparisons.

Why look at both versions of DSCR? As we all know, bond indentures may differ greatly in terms of what is allowed to be included in the definition of “Net Revenues Available for Debt Service.” For instance, many indentures allow for non-recurring revenues to be included, but others may not. Certain non-operating revenue items may also be counted for coverage computation purposes.

From an issuer’s standpoint, the only formula that matters is the one stipulated in the bond indenture. For a credit analyst, failure to maintain compliance with rate covenants, where an issuer pledges to generate net revenues sufficient to maintain a minimum level of debt service coverage, is usually an early indicator of credit problems. If left uncured, such non-compliance may result in an event of technical default.

As critical as the “as reported” numbers may be, many analysts still look for a consistent approach to debt service coverage computations, where the same formula is used in all cases. This allows them to compare issuers within the same sector and across different sectors. Since the standardized formula doesn’t include non-recurring or extraordinary items, one may argue that this is the more conservative approach.

Let’s take a look at an actual example: the case of the Los Angeles Department of Airports (a.k.a. Los Angeles World Airports or LAWA), which owns and operates Los Angeles Airport (LAX) and Van Nuys Airport (VNY) for the City of Angels.

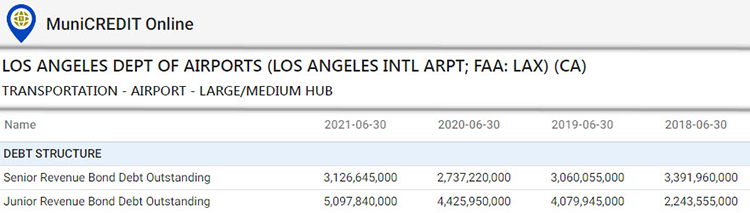

Debt Structure

LAWA’s General Revenue debt level stood at $8.3 billion as of FY2021, with roughly a 40% Senior/60% Subordinate mix. The Department also floated its first Customer Facility Charge Revenue issue back in May of this year, a $546 million deal which carried a “Green Bonds” label.

Table 1

Financial Impact of the Pandemic

As was the case with most other airports worldwide, LAWA’s finances were significantly impacted by the air travel declines due to the Covid-19 crisis, as seen in Table 2.

Table 2

A quick glance at Table 2 would lead you to the following observations:

- Operating Margins dropped almost 20 percentage points between FY2019 and FY2021, on the back of a 67% decline in total enplanements over the same period due to the pandemic.

- The Department did an excellent job maintaining liquidity at over 400 Days Cash On Hand, with FY2021 seeing a one-time spike to 705 days from federal relief.

- Since debt levels could not get adjusted during the Covid-19 crisis, all leverage ratios deteriorated over the last three years: the Debt-to Operating Revenues ratio shot up to 9.02x, compared to just 5.08x in FY2019 and Debt as a Percentage of Total Capitalization rose to 62.23%, versus 57.39% in FY2019.

The most notable trend, however, is the increasing divergence between the DSCR, computed based on a standardized formula, and the actual DSCR submitted by the Department, ostensibly computed in accordance with the bond indenture. While the standardized DSCRs steadily declined over the last three years from 2.50x to 1.22x – which would make sense in the context of the pandemic – the “as reported” DSCRs actually remained stable at around 3.4x.

In fact, the “as reported” Debt Service Coverage Ratios benefited from the inclusion of a massive amount of pandemic-related federal aid in FY2021, as disclosed in the CDR dated 12/22/2021:

- $249.3 mm in CARES Act grants applied directly as an offset to Operating Expenses

- $10.5 mm in PFC-related CARES Act grants used to offset debt service requirements on the Senior Bonds

- $11.4 mm in PFC-related CARES Act grants used to offset debt service requirements on the Subordinate Bonds

As mentioned before, the standardized DSCRs are clearly more conservative metrics as they give us insights into the Airport’s financial cushion based only on recurring operating sources. From that standpoint, one has to be impressed with LAWA’s financial resiliency throughout the Covid-19 crisis, even when factoring out the massive amount of federal assistance. The Department’s current bond ratings of AA/Aa2/AA from S&P, Moody’s and Fitch, respectively, appear well-deserved.

Conclusion

Providing our users with alternative versions of Debt Service Coverage ratios is another unique feature of our MuniCREDIT Solutions database, designed to facilitate credit monitoring by all market participants. If during the course of your daily investment activities, you find yourself wishing for a certain credit research tool, chances are we may already have thought of it!

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.