Resources

MuniCREDIT Insights | Tower Health’s Continuing Financial Struggle

Tower Health is one of the many healthcare systems struggling financially. We use MuniCREDIT Online to delve into its numbers and point out key trends

Tower Health (Tower), one of the largest health systems in Pennsylvania, formerly known as the Reading Hospital Obligated Group, continues to struggle financially. This is despite a strong national reputation and a recent string of member hospital closures. Last week, the system announced its latest divestiture, the sale of its Chestnut Hill Hospital in Philadelphia to a consortium headed by Temple University Health System, in an effort to bolster its thinning cash reserves.

To add insult to injury, on September 20, Fitch Ratings downgraded Tower Health from “B+” to “CCC+”, only a stone’s throw from the dreaded “D” rating.

A Dismal Financial Profile

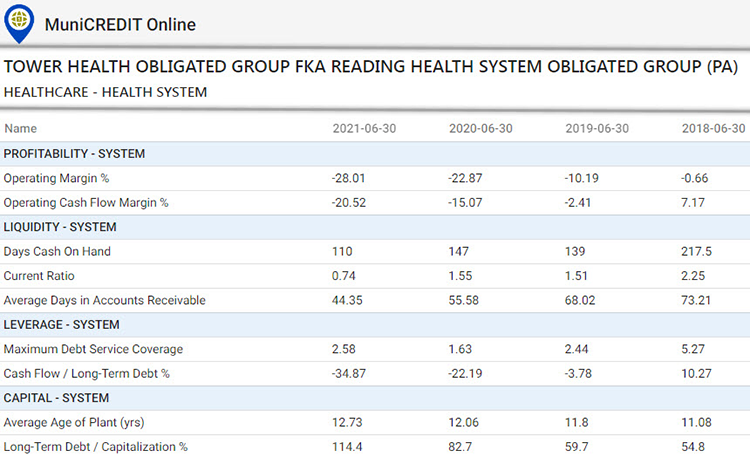

“Weak” doesn’t even begin to describe Tower’s recent financial trends, as summarized in Table 1.

As you can see, all profitability measures have been deeply in the red for the last 3 years, and still trending down. Leverage ratios, such as Long-Term Debt as a Percentage of Capitalization, have also risen, to a shocking 114% in FY2021. Most importantly, liquidity ratios such as Days Cash On Hand and the current Ratio have also been on a similar negative path. While our quick summary is not meant to capture all the nuances of this very complex healthcare credit, the key trends are nevertheless quite evident.

On a more positive note, the System has been able to meet its rate covenant, with a reported Maximum Annual Debt Service Coverage ratio of 2.58x in FY2021 and 2.46x in FY2022 (the latter still unaudited).

Unaudited results for FY2022 (not shown here) show further deterioration in the system’s liquidity position, which Fitch mentioned as one of the drivers for its latest rating downgrade.

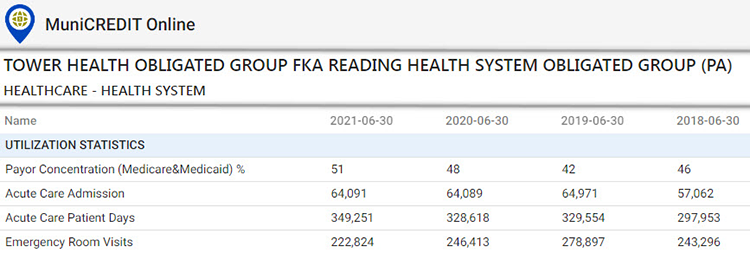

From an operating standpoint, Tower Health’s payor mix is also a source of concern, as shown in Table 2:

The health system has been growing increasingly dependent on the Medicare/Medicaid programs, to the tune of 51% of net revenues in FY2021, up from only 42% in FY 2019. Medicare alone accounts for about 36% of FY2021 net revenues.

The Statutory PAYGO Sequester

With its significant Medicare exposure, Tower Health is vulnerable to the latest threat to the healthcare sector’s creditworthiness: the need for Congress to provide relief for health providers from potential Medicare cuts that will be triggered under the so-called “Statutory PAYGO Sequester”.

The American Hospital Association (AHA) has released a fact sheet summarizing the implications of the PAYGO Sequester as follows:

“The Statutory Pay-As-You-Go Act of 2010 (Statutory PAYGO) requires, among other things, that mandatory spending and revenue legislation not increase the federal budget deficit over a 5- or 10-year period. Should such legislation be enacted without offsets, the Office of Management and Budget (OMB) is required to implement sequestration, or across-the-board reductions, in certain types of mandatory federal spending. Medicare benefit payments and Medicare program integrity spending would be cut, but the reduction cannot be more than 4%.

The Congressional Budget Office previously estimated that a Statutory PAYGO sequester in fiscal year 2022 resulting from the American Rescue Plan Act of 2021 passage — the $1.9 trillion COVID-19 relief package passed in March 2021 — would cause a 4% reduction in Medicare spending, or cuts of approximately $36 billion. At the end of 2021, Congress deferred action on waiving Statutory PAYGO, so Congress still needs to waive these cuts to prevent them from taking effect in 2023 (…)” (Source: American Hospital Association).

Clearly, this is the last thing health systems around the country need as they stare at a potentially difficult 2023. A recent report from Gibbins Advisors, a healthcare restructuring firm, predicted an uptick in hospital bankruptcies in 2023 as a result of: (1) inflation and interest rate increases; (2) a national nursing shortage; (3) significant labor cost increases, and (4) the need to repay Medicare Advances. Although the report is admittedly self-serving, it does a good job of summarizing the ongoing challenges faced by the nation’s health providers.

Conclusion

Regardless of the results of the midterm elections, municipal analysts should keep an eye on the lame duck Congress, which must act to waive the Statutory PAYGO, or risk triggering a rash of bankruptcies among financially struggling health systems such as Tower Health. Most Capitol Hill observers expect a vote on this matter on or around November 20, before the holiday recess.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.