Resources

MuniESG Insights | Focus on “Environmental Risk”: San Diego Unified School District

San Diego USD has a strong financial profile and a carbon transition liability that can likely be accommodated by the district’s tax base and fiscal resources. However, its environmental risk scores are another story. We dive into the components of this score to uncover some surprises.

The San Diego Unified School District (USD) recently came to market with a $500 million GO issue. The deal was notable for its enhanced unlimited ad valorem tax pledge as well as its “Green Bond” designation.

Although the District itself is already highly rated (Aa3 by Moody’s and A+ by Fitch), it sought to obtain an even higher rating for this particular issue as a “Dedicated Revenue” structure, based on the statutory lien and lockbox mechanism on pledged property taxes. Fitch went along with the District’s pitch, assigning the Series 2022 (and parity bonds) a “AAA” rating under its Dedicated Revenue framework, well above the “A+” IDR rating it has for the District. Moody’s wasn’t as convinced, but still acknowledged the strong security with Aa2 rating, only one notch above its issuer rating for San Diego USD.

The Series 2022 bonds also touted a “Green Bond” designation by Kestrel Verifiers. The “Green Bond” label is only a one-time designation, with no post-issuance monitoring for continuing adherence to the ICMA Green Bond Principles. The District itself only gave a perfunctory, non-binding promise to use the proceeds for “green” educational projects. In fact, the Official Statement clearly states that “the District is free to alter its proposed use of Bond proceeds and the Bonds could lose their “green” status” (page 10).

As we’ll see below, the District as an obligor actually has a fairly unfavorable Environmental Risk profile, based on the ESG framework developed by our partners at SRS.

Strong Financials But High Fixed Liabilities

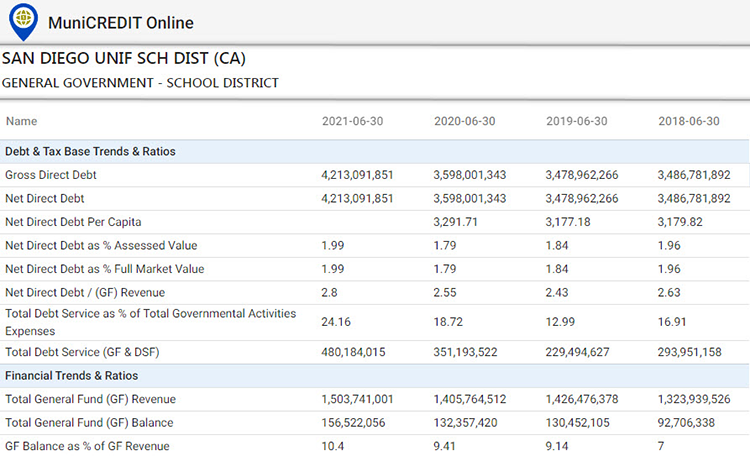

In our MuniCREDIT Online application, San Diego USD displays a strong financial profile, with ample taxing capacity, relatively low debt relative to its tax base and a comfortable General Fund balance. The only detracting factor is the relatively high and still rising share of Total Governmental Activities Expenses going to Debt Service.

Surprisingly High Environmental Risk Exposure

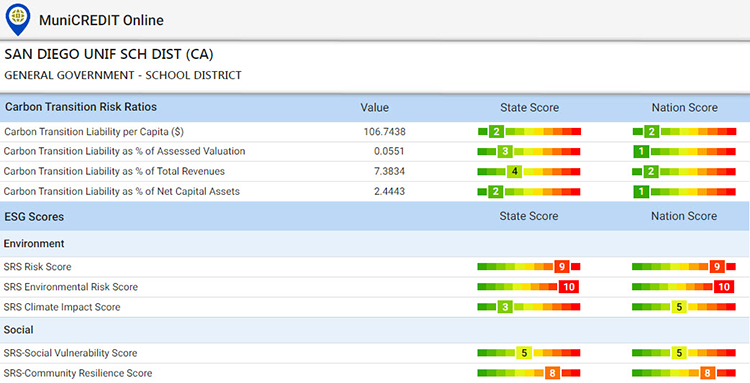

As we all know, the two key components of the “E” factor in “ESG” are carbon transition risk and physical risk. The latter can be further broken down into two elements: climate impact risk and environmental risk (not to be confused with the overall “Environmental” category, the “E” in “ESG”).

Our partners at SRS estimate the potential carbon transition liability for San Diego USD at around $117 million annually. This amount can be easily accommodated by the district’s extensive tax base and fiscal resources, resulting in a very favorable carbon transition risk scores versus other school districts within California and across the US.

As Table 2 shows, climate risk concerns are also subdued for this Southern California school district. The District compares very well with its peers within the State and its climate impact risk score is only average (score of “5”) versus other school districts in the nation, despite the obvious earthquake risk attached to most California issuers.

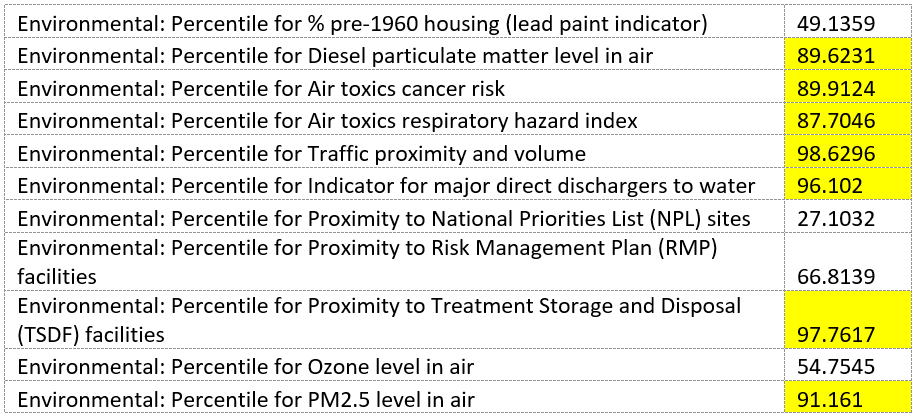

The only fly in this ointment is the District’s surprisingly high environmental risk score of “10”, versus both in-state and out-of-state school districts. The SRS Environmental Risk score is probably the least intuitive of all ESG scores, since it’s based on data not generally available to the general public or the media. We thought this would be a good opportunity to dive into the components of this score, as shown below:

San Diego USD Environmental Risk Score Components

As you can see, out of the 11 metrics that contribute to the overall Environmental Risk Score, 7 are above the 80th national percentile (highlighted in yellow, above), resulting in an overall score of “10” (highest decile).

Conclusion

The San Diego USD’s weak “environmental risk” score doesn’t necessarily conflict with the “Green Bond” label for the 2022 Series. The SRS Environmental Risk score is at the Obligor level, while the “Green Bond” label only applies to individual bond issues. An issuer like the District with a weak environmental score can still issue debt that is targeted for sustainable projects. Having said that, the ideal would have been for the District to first recognize and disclose its environmental or social issues (however defined), and then bring to market labelled bonds to address those very issues. We believe the haphazard approach seen here is one of the reasons the market has been reluctant to award any significant “greenium” to labelled bonds.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, and on our MuniESG scores, including details on the 18 sub-components of the Climate Impact Score (hurricanes, tornadoes, wildfire, etc.), please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.