Resources

MuniESG Insights: ALAMEDA COUNTY, CA: A High Risk “AAA”?

The County of Alameda, CA, has a financial profile that is in sharp contrast to its ESG risk levels. We break this scenario down for you using MuniCREDIT Online and MuniESG risk scoring.

Municipal investors are increasingly paying attention to ESG risk factors when evaluating bonds for purchase. What to do when an obligor’s financial profile stands in sharp contrast to its ESG profile?

A case in point: the County of Alameda, CA, which is in the market this week with a new $340 million (est.) of taxable General Obligation bonds Series 2022 B. The bonds are labeled as “Social Bonds” and rated Aaa/AAA/AAA (Stable) by Moody’s, S&P and Fitch, respectively.

A Sterling Financial Profile

Alameda County, CA, covers much of the East Bay area near San Francisco, an economically vibrant community of over 1.6 million residents, with the City of Oakland as the county seat.

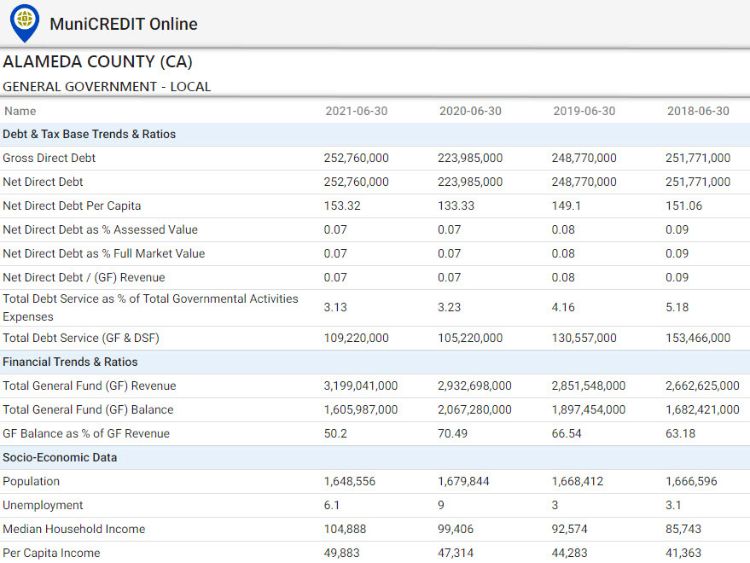

A quick look up in our MuniCREDIT Online service will tell you that the County currently enjoys extremely strong financial results (Table 1). Its total General Fund (GF) balance exceeded 50% of GF Revenues in FY2021, with the unrestricted fund balance at just under 10%. Its debt burden is quite light, with net direct debt per capita of only $153. Total debt service accounts for only 3.13% of total governmental activities expenses. Pension and OPEB funding policies are also quite robust.

Extreme Physical Risk Exposure

When it comes to Physical Risk exposure, the County stands at the opposite end of the spectrum.

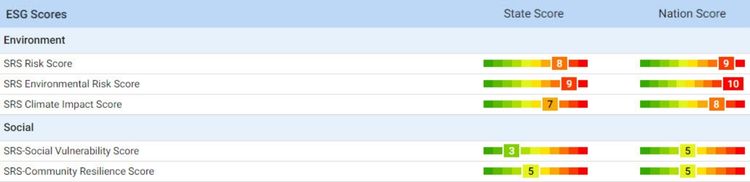

As shown in Table 2, our partners at Spatial Risk Systems (SRS) give the County an “Environmental” score of “10” (i.e., the worst decile ranking) compared to other counties nationwide and a score of “9” (i.e., 9th worst decile) versus its peers within the state. The SRS “Environmental” factor measures local pollution levels, proximity to toxic waste sites, etc.

The County also scores poorly on the SRS Climate Impact scale, which takes into account both the probability of occurrence for chronic and acute hazards and the estimated annual loss from such natural disasters. In this regard, Alameda scores a “7” and an “8” versus other counties in the State and in the country, respectively.

Alameda County’s extreme Climate Impact exposure is, of course, driven primarily by high earthquake risk exposure. The county may in fact qualify as the poster child for seismic risk as it lies right along the famous Hayward fault line, which runs through the East Bay area from San Jose through Richmond. According to the US Geological Survey (USGS), the probability of the so-called “HayWired Earthquake Scenario” going off is currently as high as it’s ever been: https://www.earthquakeauthority.com/Blog/2019/hayward-fault-earthquake-prediction

As a potential offset to its extreme climate exposure, the County does display socio-economic characteristics that would allow it to withstand and rebound quickly from any climate hazard event: both its Social Vulnerability and Social Resilience scores are at or below average, compared to other counties state-wide and nationwide.

Low Transition Risk

When it comes to carbon transition risk, the news is better. SRS estimates the County’s annual Scope 1 and 2 carbon emissions footprint at about 4.9 million tons, which translates to a potential annual dollar exposure of $204.5 million, based on a social cost of carbon estimate of $42/ton. Due to the county’s strong fiscal position and high wealth levels, this estimated carbon transition “liability” can be easily handled by the County if necessary, as shown in Table 3.

“Social Bonds”

As you can see from the above, our ESG risk scoring is at the obligor level, which is distinct from individual bond issue labeling. Individual bond issues can be labeled as “green” or “social bonds,” depending on the intended use of proceeds. The Series 2022B has been certified as “Social Bonds,” with bond proceeds going to fund affordable homeowner and rental housing programs, ostensibly in response to housing affordability issues throughout the County.

Conclusion

Earthquake risk in California is certainly nothing new, and one almost has to accept it as a cost of doing business in the Golden State. With ample advance warning from the scientific community, Alameda County has already put in place a very advanced disaster preparedness and emergency management plan. Having said that, one can’t help but wonder whether a credit with this level of “E” risk can truly be viewed as a gilt-edged “AAA.” It would be interesting to see if the pricing for the Series 2022B reflects any kind of premium for the elevated physical risk, although any such concession could be potentially offset by the “Social Bond” designation.

While the pricing for tax-exempt deals in California is usually distorted by high demand from state residents for the double tax exemption, this new issue is taxable and thus may provide a clearer picture of how the market currently views this type of credit.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, and on our MuniESG scores, including details on the 18 sub-components of the Climate Impact Score (hurricanes, tornadoes, wildfire, etc.), please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.