Resources

MuniCREDIT Insights: Montefiore Medical Center Obligated Group

The Not-For-Profit Healthcare sector was mentioned by Municipal Market Advisors and Citigroup as a sector to watch in the post-CARES Act environment. Let’s take a look via MuniCREDIT at one healthcare system that could be at risk of a major downgrade.

The credit quality of the municipal sector is widely viewed as peaking at this time. Many analysts are starting to express concerns about rising credit risk in certain sectors, once the massive Covid-related federal assistance money runs out.

The Not-For-Profit (NFP) Healthcare sector was recently mentioned by both Municipal Market Analytics (MMA) and Citigroup as one of the sectors to watch in the post-CARES Act environment. Lower quality, marginal credits are especially at risk of crossing into “junk” (i.e., below investment grade) territory.

DPC Data’s MuniCREDIT Solutions database includes key financial and operating data on over 600 NFP Healthcare Obligors, including health systems, stand-alone hospitals, and community hospital districts.

Let’s take a look at one of the Obligors who could be at risk of a major downgrade: the Montefiore Medical Center Obligated Group in New York, with about $2 billion of debt currently rated Baa3 by Moody’s and BBB- by S&P.

Weak Financials

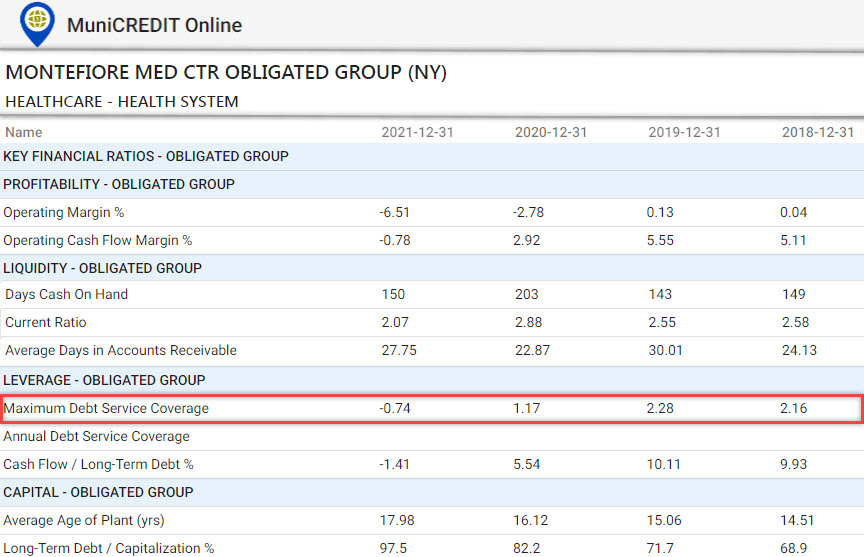

- As highlighted in Table 1, Montefiore appears to be already in violation of its debt covenant: It reported Maximum Debt Service Coverage of less than 1.00x, -0.74x to be exact.

- The last four years have steady deterioration in both Operating Margin and Operating Cash Flow Margin.

- Liquidity has also been weak, with Days Cash On Hand hovering around 140-150 days, except for a brief spike to 203 days in FY2020, probably as a result of federal assistance.

- System leverage is high and still rising, with Long Term Debt at almost 100% of total capitalization. To make matters worse, the Average Age of Plant is relatively high at 18 years, an indication of potential needs for large capital improvements and of course, even more debt.

Poor Quality of Care

When it rains, it pours. Against such a dire financial backdrop, this healthcare system was recently given a 2021 Hospital Quality Star Rating of “1” by the Centers for Medicare & Medicaid Services (known as “CMS”). This puts Montefiore among only 192 hospitals (out of 3,093 nationwide) scored by CMS in its lowest category. CMS assigns star ratings from 1 to 5 (worst to best) to 3,093 hospitals nationwide based on their performance across five quality categories: mortality, safety, readmission, patient experience, and timely and effective care.

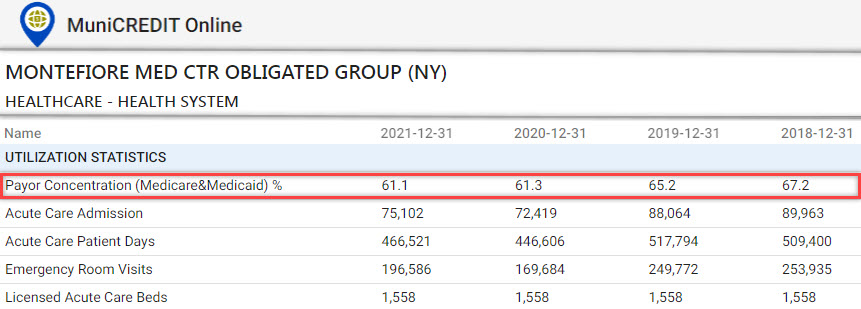

Given such a weak quality rating, users of MuniCREDIT Online can quickly check Montefiore’s payor mix under “Utilization Statistics”. In fact, the system is quite dependent on Medicare and Medicaid patients, who accounted for over 61% of admissions in FY2021 (Table 2).

Conclusion

The weakening financial indicators and the low patient care quality score combine into a very worrisome outlook for this large NFP healthcare system. Barring a dramatic turnaround in FY2022, Montefiore appears to be on course for a downgrade by the rating agencies.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal Obligors across all major sectors, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.