Resources

MuniESG Insights: Eau Claire County, Climate Change Pioneer

Eau Claire County, WI, has already achieved its 2030 carbon emission reduction goal, almost eight years ahead of schedule. We took a closer look at the county’s ESG profile via MuniCREDIT Online.

On July 12, 2022, Eau Claire County, WI, announced it had already achieved its carbon emission reduction goal set for 2030, almost eight years ahead of schedule (County exceeding emission reduction goals | Daily Updates | leadertelegram.com ). This goal was part of the county’s May 2019 resolution to achieve 100 percent renewable energy and carbon neutrality by 2050.

In light of this remarkable achievement, we took a closer look at the county’s ESG profile, available through our MuniCREDIT Online tool.

Overall Environmental and Climate Impact Scores

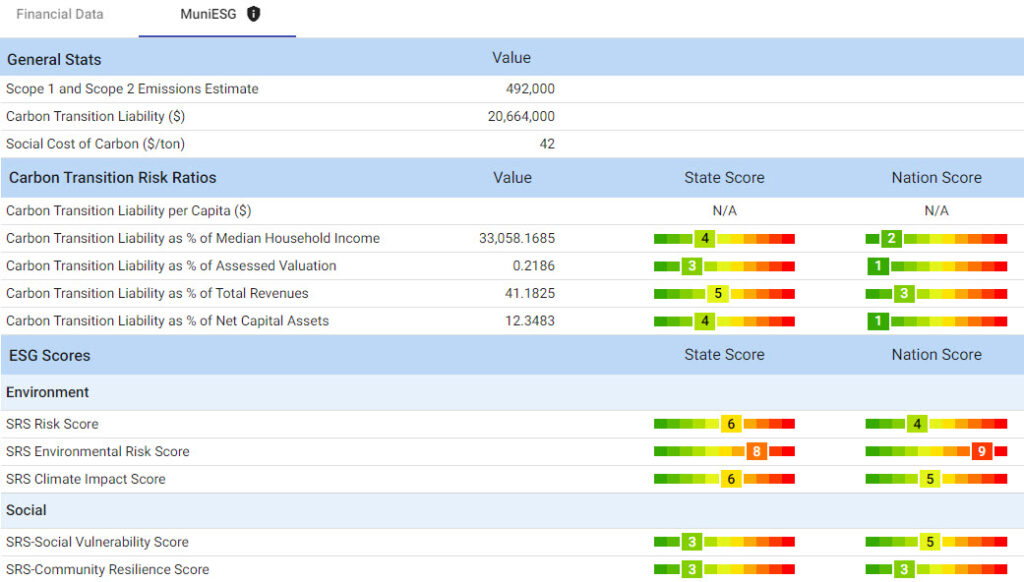

The county scores very well on most ESG indicators (Table 1), compared to both its peers within Wisconsin and around the nation.

Eau Claire County already has a very manageable carbon transition risk profile, certain to be improved further by its desire to reach carbon neutrality by 2050.

The only notable exception is the “Environmental” factor, which measures local pollution levels, proximity to toxic waste sites, etc. On this risk factor, the county is in the 90th highest percentile (a score of “9”) compared to other counties in the US, and in the 80th percentile (a score of “8”) versus other Wisconsin counties.

Social Scores

As shown in Table 1, the county displays socio-economic characteristics that would allow it to withstand and rebound quickly from any climate hazard event. Both its Social Vulnerability and Social Resilience score are below average, compared to other counties state-wide and nationwide.

Climate Impact Component Scores

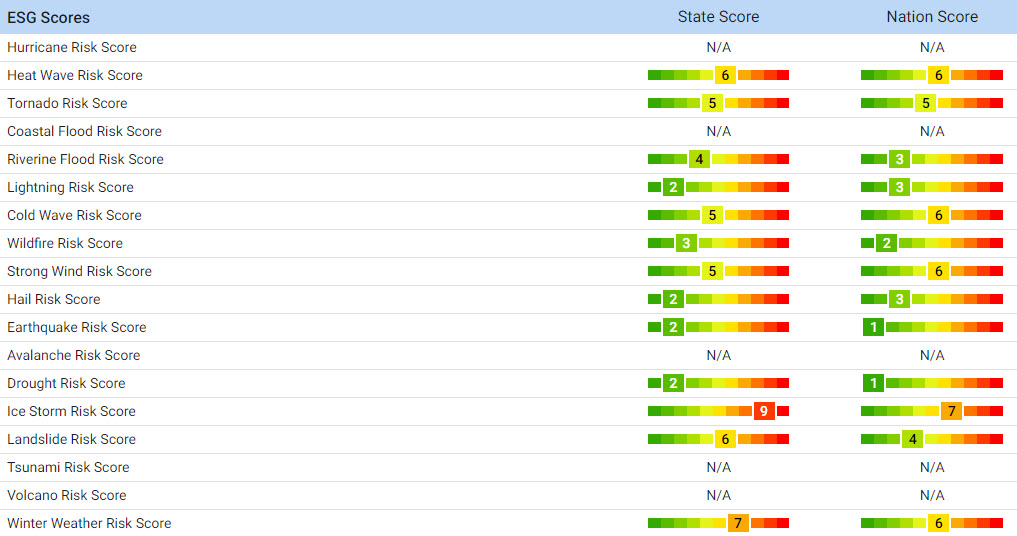

Users of MuniCREDIT Online also have access to the sub-component scores related to the 18 most common chronic and acute climate hazards, as shown in Table 2.

Eau Claire County scores below average on the majority of these risk factors. “Ice Storm Risk” is the only outlier. Note that the Climate Impact component scores, as designed by our partner at Spatial Risk Systems (SRS), take into account both the Frequency of Occurrence as well as the Estimated Annual Loss from such event.

Governance

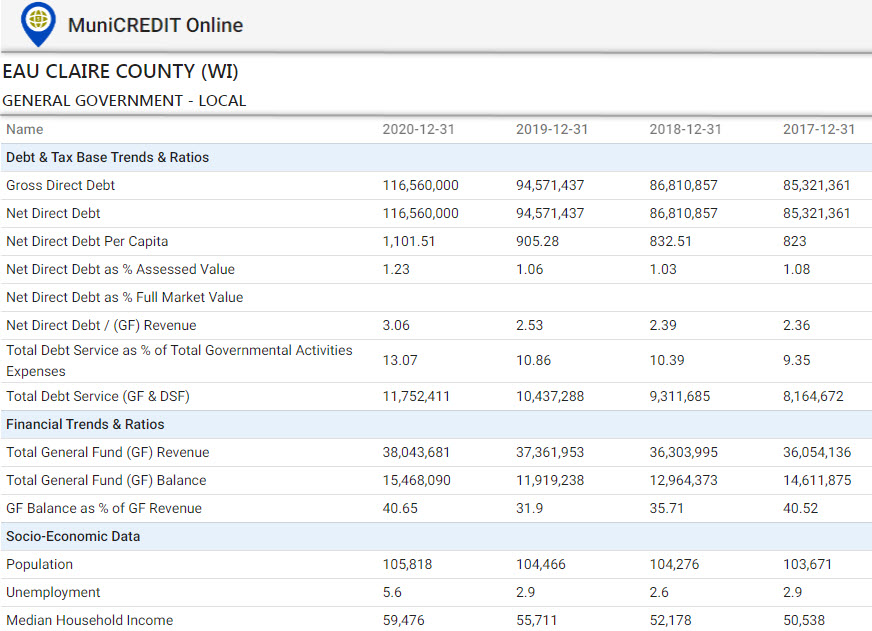

Users of MuniCREDIT Online can also look at certain financial ratios to get a rough gauge of the quality of the county’s “Governance”. In this regard, the County has a history of strong fiscal management, as evidenced by a General Fund balance to GF revenues ratio of 41 percent in FY 2020 (Table 3). This is quite a comfortable cushion and a 103 percent funding ratio for its share of the State’s Retirement System’s Net Pension Liability.

Where’s the Disclosure?

Sadly, the county’s latest bond offering document made absolutely no mention of the county’s climate achievements. We tried and could not find any mention of the word “climate” in the official statement for the county’s General Obligation Highway Facility Bonds, Series 2022A, dated 4/4/2022. The only ESG-related item we saw was a standard disclosure paragraph on cybersecurity risk in the “Risk Factors” section.

Clearly, this is the case where the county should have taken control of its ESG narrative: (1) by telling investors it is aware of its environmental and climate risk exposures; and (2) by showing how it has proactively addressed those risks. We believe bondholders would view such disclosure quite positively.

Who knows? Such a disclosure program might have saved the county a few basis points in interest cost while attracting new climate-conscious investors.

Learn more about MuniESG Scores

For more details on our MuniESG scores, including details on the 18 sub-components of the Climate Impact Score (e.g., hurricanes, tornadoes, wildfire, etc.), please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.